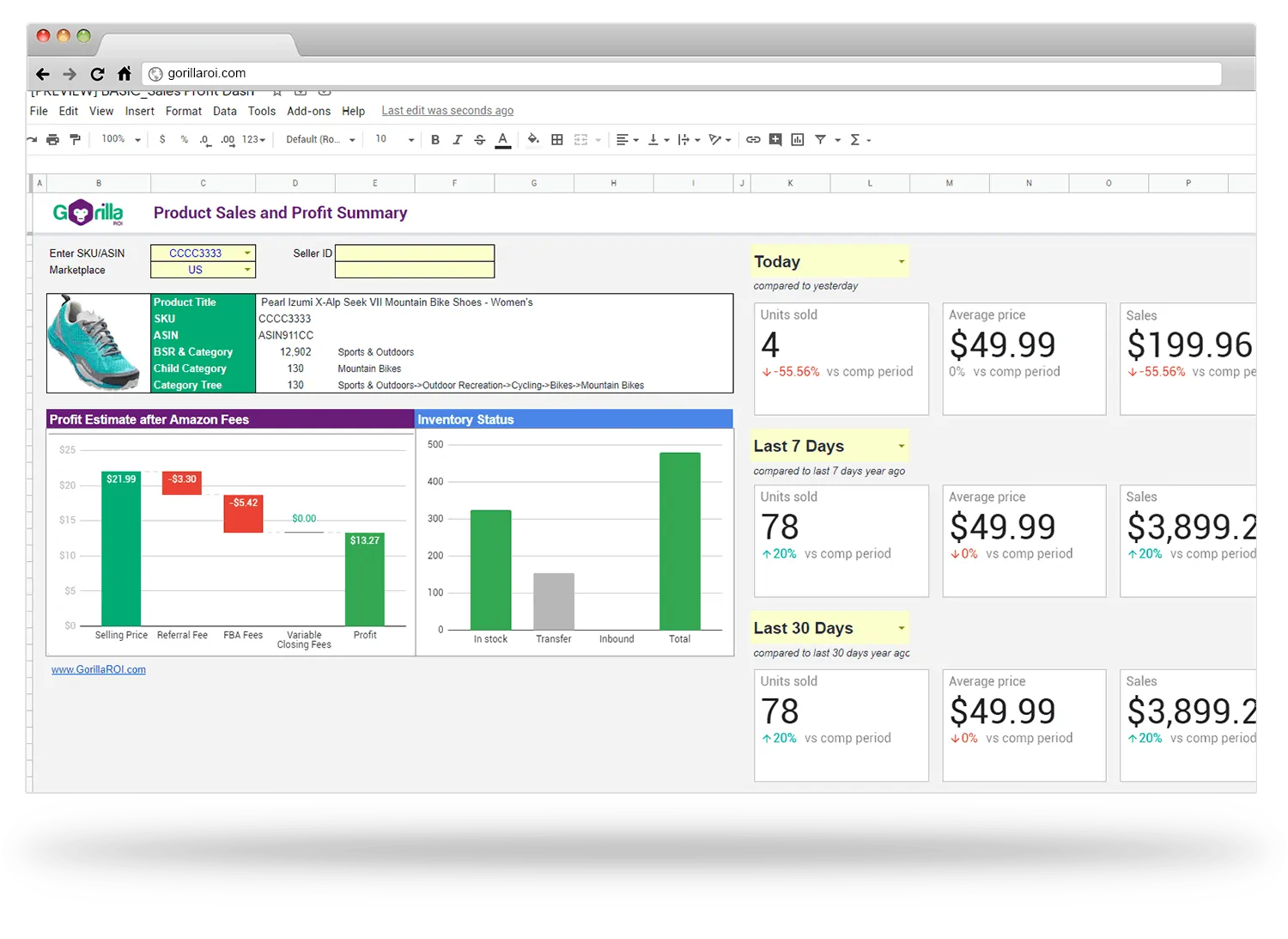

Here’s the current Gorilla ROI Amazon sales progress. To see the interactive version, go to our income reports page.

Note: These monthly updates are for educational purposes.

Article Summary (TL;DR)

✅ Explore the performance metrics and milestones achieved in December for our FBA business, reaching $495K in sales.

✅ Gain insights into the challenges faced and lessons learned during the month, highlighting opportunities for improvement and future growth.

✅ Learn about the strategies implemented to drive sales growth, including inventory management, pricing optimization, and marketing efforts.

It’s officially in the books.

We ended the year strong and hit the $5M goal we set a couple of years back. The first bar chart above shows $5.15M for the full year.

Agenda in this post.

- December and this year’s summary

- Wins and fails of the year

- What’s next after $5M?

- Supply chain concerns and what to expect the following year

- New highly requested Gorilla ROI functions and data

First, the numbers as usual.

December stats

- $495k in sales

- 96% growth from the same month last year

- 14% growth from the previous month

- Conversion rate of 37%

- ACoS is 24.8%. TACoS was 9.7%.

- This month Sales to Inventory ratio was 1.86

- Last month Sales to Inventory ratio was 1.42

I started sharing the Sales to Inventory ratio in the Nov report. The higher the ratio, the better.

1.86 compared to 1.42 last month means 3 things.

- Sales increased OR

- Inventory value decreased OR

- Sales increased AND inventory value decreased

In December, it was the 3rd one, which is the best result as it means we sold more and drew down inventory values. Just in time to close the books for 2020 🙂

To get the biggest tax benefit, I obviously want the inventory asset to become a COGS so that it becomes expensed.

Then in January, we start building up inventory again before Chinese New Year.

This Year in Stats

Metrics for the total year as well as some other simple ones.

- $5.15M in sales

- Average conversion rate of 27.5%

- Sales to session ratio of 4.38. This means the value of every session is worth $4.38. A basic way of calculating cost of acquisition for Amazon traffic.

- Last year ACoS I don’t know because Amazon doesn’t let you go back that far.

- Last year TACoS 8.35%

- GMROI (Gross Margin to Inventory) is an annual number I measure. Introduced it in last year’s report.

GMROI = GROSS PROFIT / INVENTORY

The higher the GMROI, the quicker your inventory turnover is, and your cash is not being locked up in inventory.

The lower the GMROI, the slower you are selling and more cash is being locked up.

In retail, a rule of thumb is to have a GMROI from 2.5 to 3.2. This means that for every $1 of inventory, it generates $2.5 to $3.2 in gross profit.

2020 GMROI for us came in at 9.14 which is lower than last years.

As a reference, these numbers were from last year for big public companies which is still relevant to understand the big picture.

- Proctor & Gamble (PG) annual GMROI = 6.4

- Helen of Troy (HELE) annual GMROI = 2.1

- Nike (NKE) annual GMROI = 3.1

- Target (TGT) annual GMROI = 2.3

- Apple (AAPL) annual GMROI = 23.9

- Johnson & Johnson (JNJ) annual GMROI = 6.3

- Johnson Outdoors (JOUT) annual GRMOI = 2.65

Apple has an exceptional GMROI of 23.9. That’s elite.

Above average is 6.0+.

Goes to show how strong the conversion rate and traffic is on Amazon.

Wins and Fails of The Year

Keeping it simple here.

WINS

- Our operations was strong in this year.

Nearly everything was in stock because we put in massive orders as soon as covid news began to spread in China.

It was big bet to order 12 months of inventory upfront, but it worked out. The huge spikes as covid and fear hit the US meant we ended up having enough to stay in stock for the next 4-6 months depending on the product.

If we didn’t order that much, we would have been out of stock in 1 to 2 months. The extra inventory we had meant we could wait for our suppliers to get back into operation while we kept selling.

Our competitors went out of stock within 1-2 months and then it took them 2-3 months longer to get back in stock with all the manufacturing capacity related issues at factories, delays with freight, Amazon etc.

While they were out of stock, we snagged a huge amount of their sales, ranked higher for keywords – all organically.

One of the biggest sins is going out of stock for best sellers.

2. Forecasting and data

Forecasting requires long term and short term data to make an educated guess.

I wrote a lengthy post on demand forecasting and planning which includes examples and data points that you can use to get better forecast numbers to stay ahead of the game.

The guide on building an Amazon inventory management system has calculations and screenshots of how I’ve built mine.

My goal is to always be proactive, not reactive.

My calculations are not complex.

- Last 7 days

- Last 14 days

- Last 30 days

Get this data for each SKU and you can see short term spikes, average trends and long term estimates.

Obviously, I’m using Gorilla ROI for my Amazon data source as there is nothing on the market that offers the flexibility and custom data points I need for my reporting and calculations on the fly.

Just don’t rely on Amazon’s basic last 30 days numbers to run your business. It’s funny how Amazon internally uses complex algorithms and AI learning to calculate employee performance, warehouse capacity, know how many and what to move between fulfillment centers and so on. But when it comes to Seller Central, they calculate your projections and recommendations on the last 30 days.

You saw how useless it was during peaks and valleys. If you trusted it during the mad covid rush of March, April, May, you experienced how silly it is.

Even in Q4 for seasonal products, the max shipment quantity is always set to 200 because their system doesn’t realize that seasonal products have low sales during offseason…

3. Team expansion

Like most of you, we like to run a lean business.

We also run a distributed team with employees in the US, Asia, South America, Europe. We added a couple extra positions this year for specialized roles and hope that we’ll be able to maximize revenue per employee.

My original metric for hiring was to achieve $250k in sales for each employee. E.g. if there are 4 people, the business must be able to do $1M in sales.

With the efficiency and automation we’ve built into the business, sales per employee is around the $500k mark.

Our average selling price is $16, so if you have a higher average selling price, your sales per employee metric should be much higher. Just an easy way to help know when to hire.

The hardest part was and is finding reliable, hardworking people to show up to warehouse jobs.

Competing with an unemployment program offering $600/week meant that 20 people will email or call saying they want the job, but then not show up.

But in the end, we did manage to bring in families and friends to help temporarily until we found some permanent people.

FAILS

- One supplier dominance

Throughout this year, I shared my troubles with one particular supplier. This was the biggest fail. Over-reliance on a single non-supportive supplier.

As we are in the cleaning space, demand went up like crazy. Up until Feb, we were discussing more quantities and lead times and so on.

Once covid hit, everything that we discussed went out the window. We were classified as an unimportant customer as they had to make orders for their huge customers.

A win within this fail is that persistance (or annoyance) worked. I kept calling, emailing, texting to get our orders accepted and processed.

Realizing how bad it could get, we started work with an existing (and very supportive) manufacturer to create our own competing version that I believe is much better. I’m stoked to start pushing it as hard as possible and hopefully get to the point where I no longer have to depend on the current manufacturer.

2. No new products

Well, we did get new products, but they came in December. Too late to take advantage of the Q4 sales rush.

Our product development time takes too long for my standards.

We create everything from scratch and that has a lot to do with it. When creating chemical products, there is so much research, trials and testing involved. 6 months fly by.

Also with physical goods, we design everything from scratch to fit our design philosophy and family of products. We don’t buy anything straight from the manufacturer or Alibaba.

But it’s still not acceptable to not have any new products until December. Sea freight backlogs delayed our deliveries by a month, but still. I need to implement a schedule of constant product development year round.

3. Diversifying platforms

Another year where Amazon made up 98% of sales.

Wholesale cratered. This year was supposed to have been the year we kept going with the strong previous year’s trajectory. Oops.

Walmart is still too small for our category of products. People naturally go for big brands on Walmart rather than small new brands.

Our website sales is seeing some traction, but there is still a long way to go. Like I said, I’m in the cleaning space. Shoppers rarely think of going to the actual brand website to purchase basic cleaning items.

It’s usually via a brick and mortar store, Amazon, Walmart or some other big retailer website.

Fighting this is the hard part, as I do want to generate at least $10k in sales via our own website and at least $50k per month across all channels outside of Amazon.

What’s next after $5M?

Now that the goal of reaching $5M has been met, what next in terms of the blog content for Gorilla?

Last month, I asked what you thought and a handful of people said they enjoy and find the monthly reports helpful.

Thanks guys.

But compared to the overall email subscribers, looks like it’s either too high level or not useful enough.

I’ll probably either make the report simpler to keep it as a journal to log my thoughts, or make it into a quarterly income report as some months are repetitive.

Maybe the new goal for blog should be for a high 8 figure exit, rather than an arbitrary $X. To keep trying and testing things until I get to a stage where I want and can leave it all and ride off into the sunset.

Supply chain concerns and what to expect in the Following Year

Just like how we took extra precaution when covid news hit, I’m keeping my eyes and ears open about the “UK variant”.

Depending on how it goes, it could mean having to order another 12 months of inventory this time. Who knows.

But before all that, current freight is c.r.a.z.y.

- Cost is double or triple.

- The backlog of shipments coming to the US is so high.

- Taking 1 month to get a booking from some ports in China

- Customs is taking longer to process and clear. Xrays exams can take 3-4 weeks at the moment.

- Chinese New Year is around the corner.

- Another big backlog of orders for when China resumes.

- More sea freight capacity limitations.

Just like this year, I don’t expect next year to be easy or smooth. Normally, I don’t like buying a lot of inventory, but when freight costs are double, lead times are double and I have the cash on hand, I’d rather make sure we have inventory because I know we’ll sell through anyways.

Go through my detailed lead time calculation tutorial to see how bad it can get. There’s a spreadsheet to download too.

Prices are also going up across the board.

- Raw material costs

- International and local labor costs

- Increase in Amazon fees

- Increase in shipping fees

- Increases in other operational costs

- Money flooded into the economy

Reviewing pricing should be a monthly matter to make sure you find the best balance of sales and profit.

We use to sell a product for $12, but because of the across the board, we now sell it for $18. Just a reality at this time and the need to consistently review prices.

Restock limits now a real thing for all marketplaces

We released the much-requested INVENTORYRESTOCK() function that pulls in all your restock report data.

We launched it first for the US market, but in a couple of weeks, it will work for ALL marketplaces that use restock limits for sending inventory.

The restock data you can pull:

- Condition

- DaysOfSupply

- Alert

- RecommReplenishmentQty

- RecommShipDate

- CurrMonthMaxInvThreshold

- Utilization

- MaxShipmentQty

You can finally stop downloading those restock reports and load it straight from your Google Sheet.

Highly requested Gorilla functions and data

We’ve been busy adding more important data points to make your life easier.

Two new marketplace filters to help EU sellers analyze data. * EU * EURO EU = Will pull combined data for all European countries EXCEPT UK. DE, IT, FR, ES, NL, SE, TR EURO = Will pull combined data for countries that use EURO currency. DE, IT, FR, ES, NL

-

NEW: Get parent SKU or ASIN. GORILLA_SKUASINPARENT(). Will pull the matching parent SKU or ASIN and display it as a SKU or ASIN.

-

Gorilla ROI Developer ID for US/CA/MX/BR. Switch to the new ID for better service and support.

Reminder from last month

-

Get restock report data (US marketplace only) GORILLA_INVENTORYRESTOCK(). You can get your inventory utilization, max ship quantity and recommendations.

-

We've simplified CHARGETOTAL() and FEETOTAL() with this new version GORILLA_FINANCES() - makes it easy to create a table for your P&L.

-

Gorilla ROI Developer ID for US/CA/MX/BR. Switch to the new ID for better service and support.

-

Our page of examples and documentation is always being updated. Easy navigation version and one page version.

More free Amazon FBA spreadsheets for all

We’ve added more templates for both basic users and PRO spreadsheet buyers. More free Amazon spreadsheets are being created too.

You can download it immediately without having to sign up for anything.

Just copy straight to your account.

If you have custom spreadsheets you use in your business already, you can automate it with our Gorilla ROI addon. Tons of flexibility to create the reports that work for your business.

Comments

Related Posts

Shopify eBay Integration for Busy Sellers: Sell Like Crazy Across 2 Channels

Using an omnichannel sales strategy can help your business reach…

Understanding Shopify COGS: A Comprehensive Guide for Business Owners

Knowing your Cost of Goods Sold, or COGS, is essential…

Boost Sales With Shopify Automation – BONUS: Our 3 Best Shopify Automation Apps

Being an e-commerce company, in particular, means that you have…

Leave a Reply