Article Summary (TL;DR)

✅ This article showcases how to compare seller claims with actual data and provides insights into financials, products, and potential issues.

✅ Overstated financials with inconsistencies and errors. Low profit margins and a declining product in a competitive niche.

✅ Don’t solely rely on seller information; verify data independently. Understand the underlying reasons for a business being sold. Carefully consider long-term viability before making a large investment.

Once in a while, I browse through a marketplace like Flippa to see if there are FBA businesses, products or listings potentially worth buying.

The interesting thing with Flippa is that the seller uploads financials for anyone to see.

No account sign up, no deposit required.

In today’s post, I’ll share the FBA business that I found, the financials and what I think after breaking down the numbers.

But first, a story of why I do this and how it helps.

Before and after

During my twenties, I went to the gym regularly to try and bulk up my skinny frame.

There were signs of life during that year where I went to the gym religiously and ate as much as I could.

But what helped the most was keeping track of progress. I’m sure you’ve seen those nerds at the gym with a pen and paper and writing things down.

That was me.

It was good while it lasted. I didn’t bulk up much, but I got enough meat on my bones to upgrade from pushover anchovy status to normal skinny guy on the street status.

Being a numbers and stats person, I like to keep track and count of what I’m doing, and where I stand. Not for the purpose of comparing, but to make sure I’m not falling behind.

It goes the same for business.

I share my income reports and thoughts on margins and what levels we are trying to shoot for. In the post about how to price products properly, I showed how we try to model ourselves after Proctor and Gamble on the financials.

This is the equivalent of having a before photo of my skinny body and an after photo of a lean and strong “after” photo.

Our current state is the before, and P&G’s is the after.

By keeping track of our financials like this, it helps us keep a healthy balance sheet and forces us to focus on making decisions that will make positive impacts to our financials.

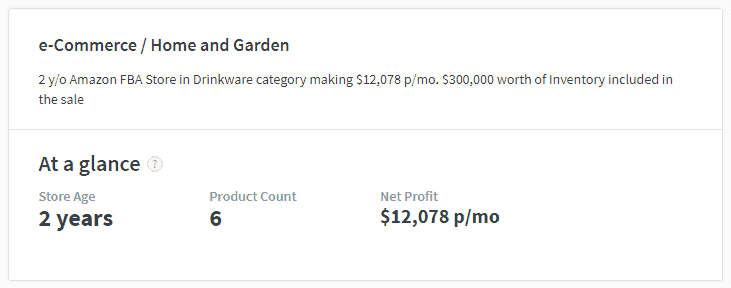

FBA business on sale for $265k

Back to the Flippa listing.

The FBA business being sold is BluePeak USA. Asking price is $265,000.

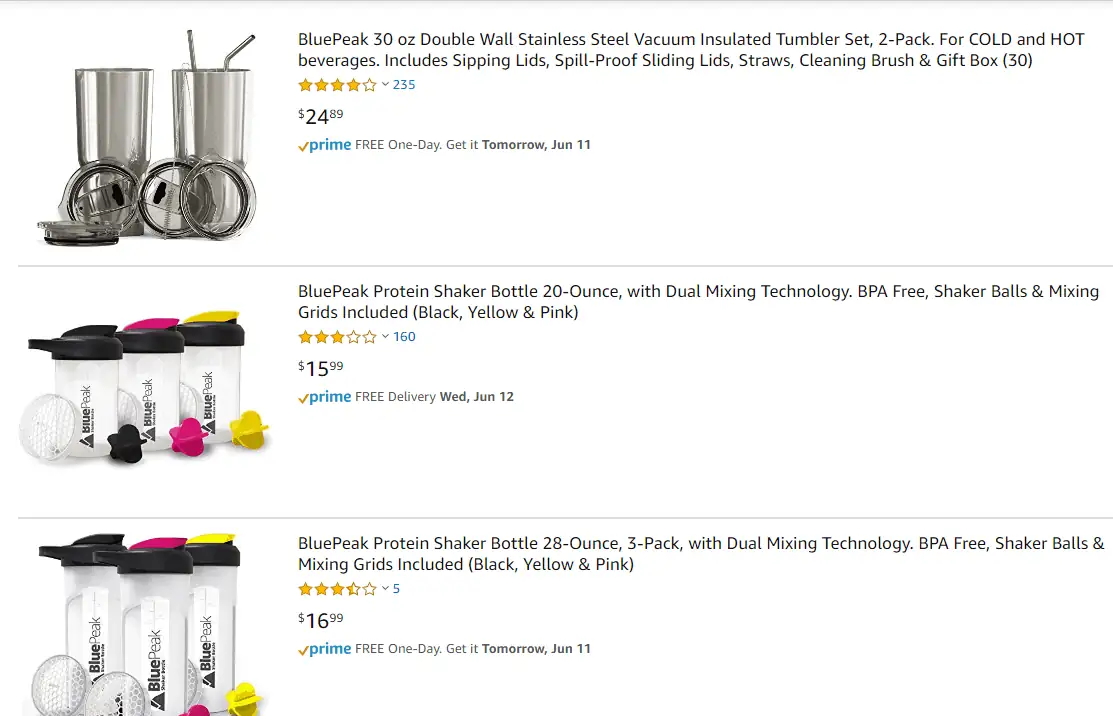

Here’s a look at their products from their storefront. Using my tips on analyzing FBA storefronts, their #1 seller at the moment are double-wall stainless steel tumblers, followed by protein shake bottles at #2 and #3. #4 is a Nespresso capsule holder.

See it for yourself while the listing is up.

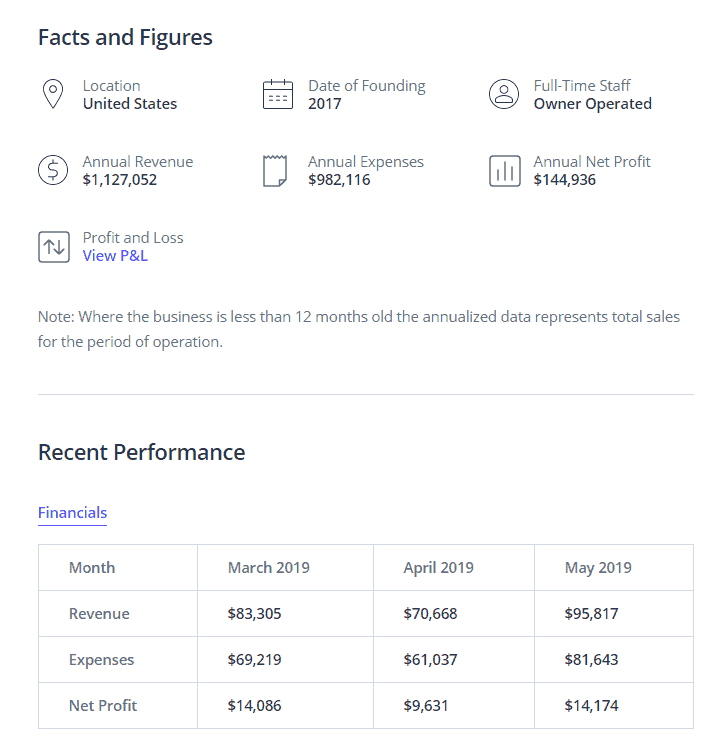

They claim the business generated $1.12M in the last year with a net profit margin of 12.9%.

The pros I see:

- Sales have been increasing.

- There are only

613 SKUs. Some are high-performing. Room to grow quickly.

The cons I see immediately:

- I don’t trust the numbers. It looks very overstated.

- The company is young so there isn’t much history to work with.

- Very competitive product and niche.

- Products reviews are going down on best-selling items.

I want to say that if the numbers were 100% accurate and not massaged in any way, then this looks to be a no-brainer deal.

$265k for a business that can churn a $140k annual profit is literally a 1.9x multiple.

But that sounds too good to be true.

Let’s see if it is.

Let’s dig into the numbers

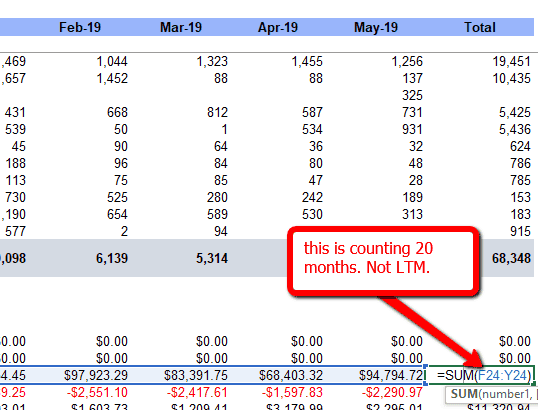

The seller uploaded financials going back from June 2017 to May 2019.

The excel file has serious errors with the total value where the seller is adding up 20 months rather than the last 12 months. They could have just left it empty which would have been better.

There are other issues where the number of columns being added are inconsistent with each other and line items are assigned in the wrong place.

Allocating a COG as an expense will only make the gross profit look much better than it really is.

Warning flag: if a seller can’t organize and upload accurate financial statements when selling their business, what else could they be hiding or missing hiding?

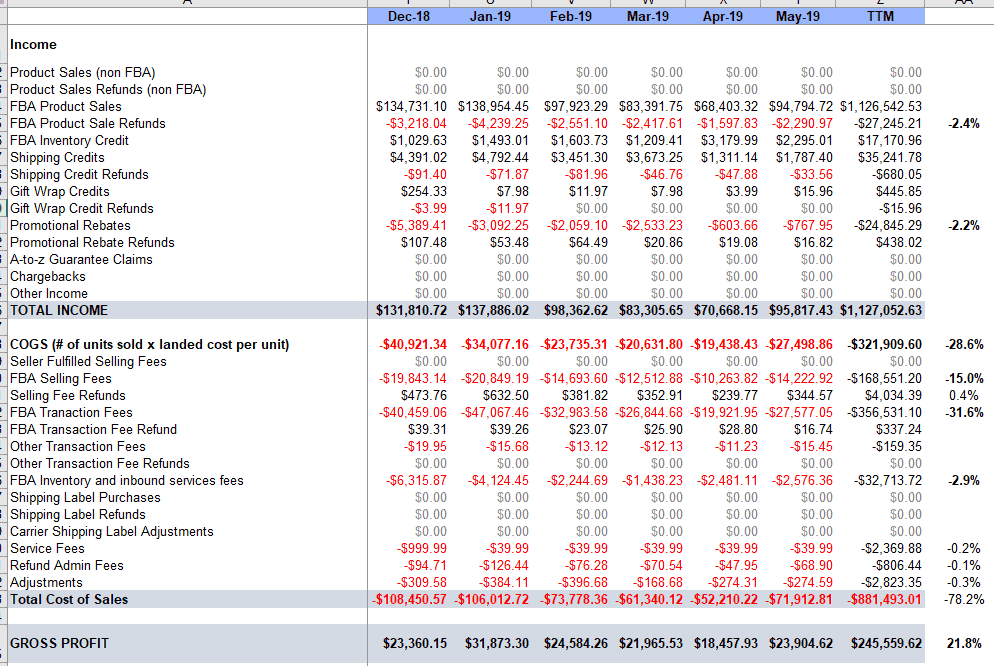

After cleaning up the financial statement and rearranging the line items properly, here’s a better representation.

None of these numbers are audited and my calculations are just based off what the spreadsheet says. I’m sure if I really wanted to buy this business and dug into the reports and transactions, I will discover a lot of discrepancies judging by the initial financials.

Original VS Corrected

- $1.5M revenue vs $1.13M revenue (overstated by 25%)

- $605K gross profit vs $245K gross profit (overstated by 60%)

- $119K net profit vs $144K net profit (understated by 22%)

If you look at the numbers as a percentage, the original statements make it look like the business is operating at:

- Gross margin of 40%

- COGS of 19%

- Amazon expenses of 59%

- Net margin of 7.9%

After correction, the numbers really reflect:

- Gross margin of 21.8%

- COGS of 78%

- Expenses of 17%

Net incomeOperating income of 13% (net income is after-tax)

The before and after paints a drastically different picture.

Originally, what looked like a high-profit margin product turns out to be a low-profit margin product in a competitive niche, with bad reviews.

If the gross margins of the business are 21.8%, it’s on thin ice. Things could go downhill quickly because as you grow, operating expenses add up quickly.

The financials only include Amazon-related expenses and Amazon PPC in the expenses line. There is nothing for payroll, social security tax, overhead, insurance, auto, R&D, customer support, fees, and other expenses that come up with running a real business.

By the time all these expenses are subtracted from the gross profit of 21.8%, you have negative operating profit and negative net profit.

Deal or no deal?

If you have extremely lean operations and can operate with 21.8% margins, this isn’t a bad deal if you just take it at face value.

Most likely you cannot have any employees, operate out of your garage, and you definitely cannot pay yourself anything.

Long way of saying – NO DEAL.

But I can see the motivation for wanting to sell.

- Reviews continue to trend down.

- Some products are close to dead.

- Seller wanting to get something out of a tough FBA product.

As I mentioned at the beginning, if I hold this company next to my requirements and benchmarks, it fails most of my boxes.

I’m aiming for 40% gross margins because I know my operating expenses will be around 20-25% and after any interest payments and taxes, my goal is to stay above 10% net profit.

You can try to analyze the business yourself. I’ve uploaded the original and corrected it.

It also brings up the important point that there is going to be a reason for why the seller is selling their Amazon FBA business. It’s up to the buyer to uncover the truth because the seller is always going to sugarcoat it or leave out the details.

However, considering that I already have suppliers that make capsule holders, there’s no reason for me to pay $265k + inventory for something that we could get done for $10k.

Summary

You can learn a lot by analyzing somebody else’s financials.

From this company alone, I can tell that the owner doesn’t know their numbers, costs are high, products are dying, margins are thin and the niche is competitive.

The business generated $1.12M in the past 12 months, but the owner is willing to sell for $265K. Not a horrible deal, but only if that person is brand new and doesn’t have the time to learn and do it from scratch.

Comments

Related Posts

Mastering Shopify’s UTMs: The Simple Way to Smarter Marketing

Let’s be honest: marketing your Shopify store without tracking what’s…

10 Profitable Product Categories for Amazon Affiliates 2025

What you’ll learn Amazon is a favorite for experienced and…

Unlock the Secret to a Profitable Automated Amazon Store: How to Build a Hands-Free Income Stream

Ever dreamed of running a profitable Amazon business while sipping…

Leave a Reply