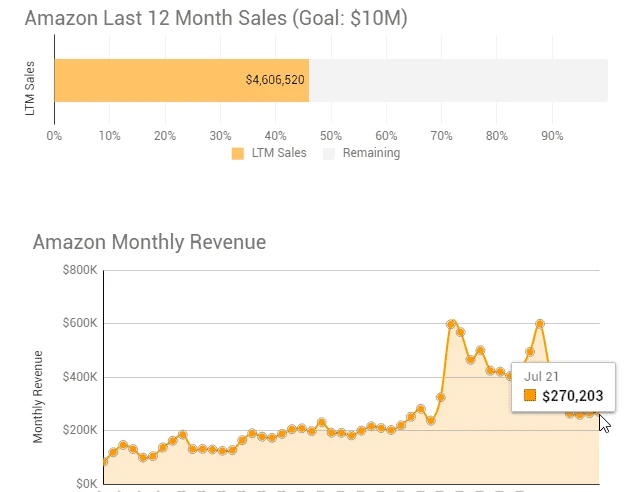

Here’s the current Gorilla ROI Amazon sales progress. To see the interactive version, go to our income reports page.

Note: These monthly updates are for educational purposes only.

Article Summary (TL;DR)

✅ Explore the performance metrics and milestones achieved in July for our FBA business, reaching $270K in sales.

✅ Gain insights into the challenges faced and lessons learned during the month, highlighting opportunities for improvement and future growth.

✅ Learn about the strategies implemented to drive sales growth, including inventory management, pricing optimization, and marketing efforts.

July’s in the books. I’ll break down what’s been going on with our Amazon business and what I’m seeing on the horizon.

- July summary

- Using a product scorecard

- Reducing mistakes, waste, and cost

- New Amazon A-to-Z claims and insurance

First, the numbers as usual.

July stats

- $270k in sales.

- Down vs last year.

- Up vs last month.

- -46% down from the same month last year

- +1.6% up from the previous month

- Conversion rate decreased to 30.4% vs 32.7% the previous month

- ACoS increased to 50%.

- TACoS increased to 24%.

Not impressive.

July was the first time in a very long time where we lost money for the month.

The funny thing is that these numbers are pretty bad, but it’s not as bad as they could have been.

Halfway into the month, when I sobered up and realized throwing money at PPC was never going to work for this particular product, I took the upfront hit and recalled several hundreds of inventory from about 15 listings and killed many morbid PPC campaigns that were sucking more blood than Lestat.

The horrific listings and campaigns were spending 200-600% in ACoS. Literally paying money to Amazon so that I can lose more money. Total madness.

Seeing how this failing product is trying to enter a brutally competitive industry with huge household brands dominating the entire market, it was going to be a miracle for it to work.

The cost to get a product ranking is higher than ever before. More competition, higher bids, more expensive to get reviews. I need to spend literally 6 figures to really make a dent and gain traction.

We did a lot of giveaways, but to maintain a velocity of 50-100 units a day for 30 days is just crazy considering the small margins.

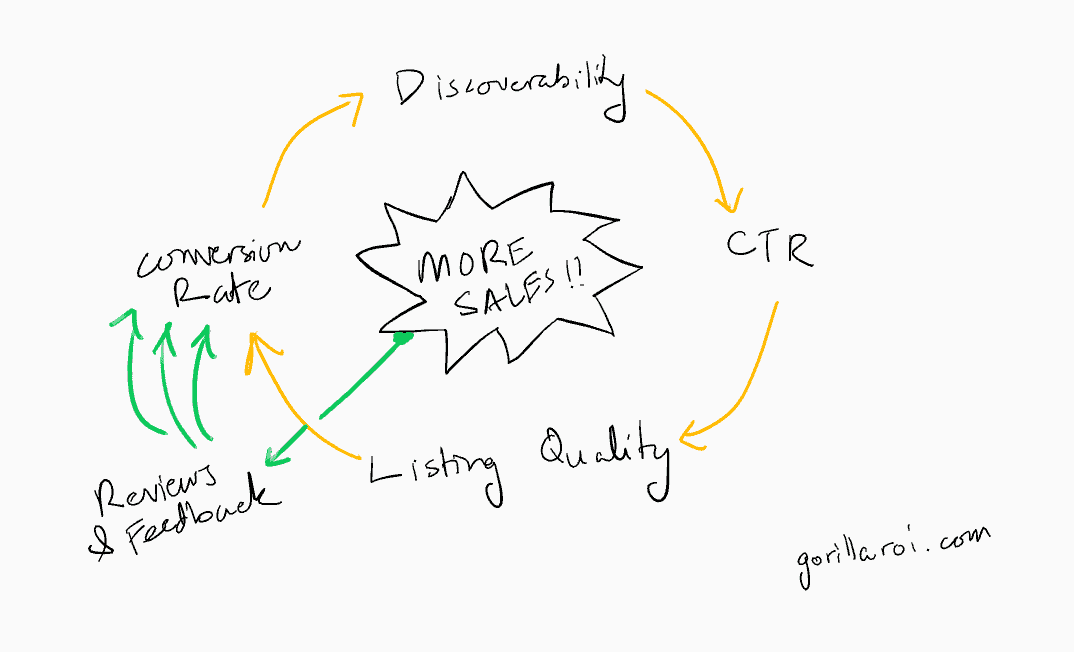

I wrote a mega guide on Amazon listing optimization and drew my version of Amazon’s flywheel, but geared towards sellers.

Everything comes down to keywords, PPC, and reviews. And then the reviews create more reviews into its own loop.

Using a product scorecard

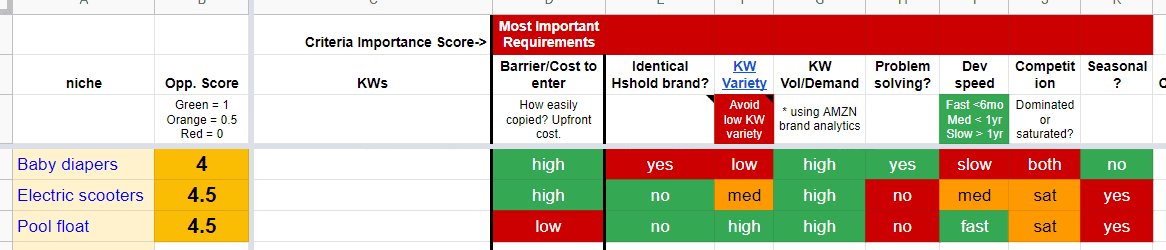

With such a bad month, it kicked my butt into documenting the failure and finally getting around to creating a product scorecard that I’ve been going through with my team.

What you see is a basic criteria list that I like to judge products on. I’ve been doing this mentally, but now it’s on a spreadsheet to log ideas and for the team to pick apart.

It’s a subjective version of the research tools like Junglescout, Helium10, or AMZScout. Those tools only give you an idea of the competitive landscape and an estimate of the sales.

If you think you found a great product, 3 months later, hundreds of other people are selling it. There’s not much in terms of what it takes to develop the product and whether you’ll be able to compete long term.

My version is manual and subjective but makes us think through its important criteria and taking the approach of building a long-term asset that will generate long-term positive cash flow, rather than a short-term get rich quick product.

The criteria we analyze are:

- Barrier to entry

- Household brand competition

- Keyword variety and discoverability

- Keyword volume

- Does it solve a problem

- Speed to market

- Level of competition

- Seasonality

The max score is 8 and when I analyzed our winners and losers, the winners score 6 and above.

Let me know what you think. I’m considering whether to include it in the PRO Amazon Spreadsheet Package or not.

Reducing mistakes, waste, and cost

Although the scorecard is still a work in progress, finally creating a firm process like this will hopefully lead to fewer mistakes and failures.

I don’t want to keep seeing these types of boxes in my warehouse.

This is just one of many pallets that came in, waiting to get checked and repackaged. It’s also why I prefer to have a local operation as we can control what happens to the excess product or having to redo the units.

Disposing of it is a waste as we are repackaging and reselling it in different bundles.

Sending from a FBA FC to a prep service center is super costly. Since all the products have to be checked, unboxed, and then put inside new boxes, that would come out to at least $0.5 to $1.50 per unit.

If I had 1000 units, that’s a minimum repacking cost of $500-$1500. If we have a box or two, that makes sense as the overall cost is low. But with thousands of units pouring in sporadically, it makes no sense.

It’s why I keep saying that there are two viable Amazon business models. Go big or stay small. Get big enough where other winning products and margins can cover the operational costs, or stay small.

If your operations are small, paying a service provider to handle 1-2 boxes won’t break the bank and it will be a helluva lot cheaper than leasing a warehouse, getting insurance, hiring people, and so on.

New Amazon A-to-Z claims and insurance

Not sure how I feel about the new policy about A-to-Z claims. For now, I’m not a fan.

For a long time, after Amazon knew it dominated the online marketplace, they have switched their entire model from helping 3rd sellers sell and grow, to focus on how to extort and make more money off them, knowing that most 3rd party sellers have nowhere else to go.

PPC exploded to sponsored brands, product targeting, videos, off-platform ads and I know they are coming up with more ways to force sellers to spend in order to play.

All of their “accelerator” features have turned to “pay us so you can get started quicker”.

A-to-Z claims previously allowed sellers to have a say. Customer disputes are now automatically handled by Amazon.

Sub $1000 claims will likely be paid out to the shopper automatically soon. Returns are automatically refunded now, and the way claims are processed will be no different in the near future.

Shoppers will find it easier to request claims and the number of claims will rise. This will lead to Amazon mandating everyone to also purchase insurance from one of their partners.

At the moment, we are free to keep our current insurers, but I can so easily see Amazon changing the rules on this.

Amazon will then collect a commission and likely a fee from the network of providers. And if they decide to increase the minimum insurance limits, that’s even more commission for them to collect like clockwork.

Try to sell on Amazon UK and EU again?

A reader asked whether I was considering trying to resell in UK and EU again.

The short answer is – no.

Although there are more countries coming online as an Amazon marketplace, I won’t be trying to sell in the UK or EU anytime soon.

Maybe if there is a serious seller with a good track record, I could work out a wholesale deal to sell to them.

Having tried it once before, it was a brutal experience due to shipping, lack of systems set up in place, and trying to keep things in stock internationally.

EU is also much stricter for certain categories and I don’t want to go through regulations and documentation to get our products approved.

Ultimately need a much larger cash reserve, time, and manpower to duplicate what we are doing in the US in another country. I’d rather focus on our main marketplace and increase the momentum.

NEW Gorilla features

- No new features that are visible to the user

- We’ve been working on backend updates and improvements overall

Articles published

- ULTIMATE Amazon listing optimization guide. Free checklist included.

- See how you can use movers and shakers to get product ideas and see trends.

- For resellers, joining the Amazon renewed program can be lucrative.

Comments

4 responses to “July FBA Monthly Update at $270k”

-

ups and down, thanks for sharing. I would love to hear more about why you wont expand to other marketplaces, i assume it’s your product types? we are exploring working with private label sellers who have no interest in going international. We do however have very strict product requirements to make sure we dont get lost in paperwork and documentation, shipping and LTSF by samazon. That being said we still haven’t worked out all the details but i hope someday we can offer that to seller who want to try out other marketplaces. Singapore and AUS have some real potential for seller we have seen in our data. Cheers.

-

When we sold in the UK, the biggest issues we faced was pricing and quality.

Sending a few pallets at a time LTL back then was still expensive. Raised the unit cost by a good chunk. Add the cost to then hire 3rd parties to handle the operations made things more expensive.

Then add the VAT into the price and the final cost was too high for the local market.We are already on the premium side in the US, so all the newly added costs and taxes was too much for the consumer.

Then on the quality side, we’ve had some issues with bad suppliers with Covid. Sending us cheap quality materials and components. Has led to lots of recalls and having to remake things. Going to be impossible to do if the units are shipped overseas and then we find something wrong with it that we missed. Crazy to ship it back, fix it, and then ship it again.

-

-

Would love to see a product scorecard with gorilla roi.

-

Interesting read. I’d say better than 75% of our clients who try the UK/EU markets fail to generate a profit from the effort. You can’t look at it as just more buyers- between shipping, VAT, localization and a generally different outlook on what products they want to buy (and for that matter- differences between countries- the “EU” is not really a market!) it’s very challenging to make it work there for most sellers. I usually advise clients to doubel down on their US efforts rather than try pushing products out to those markets.

Related Posts

Mastering Shopify’s UTMs: The Simple Way to Smarter Marketing

Let’s be honest: marketing your Shopify store without tracking what’s…

10 Profitable Product Categories for Amazon Affiliates 2025

What you’ll learn Amazon is a favorite for experienced and…

Unlock the Secret to a Profitable Automated Amazon Store: How to Build a Hands-Free Income Stream

Ever dreamed of running a profitable Amazon business while sipping…

Leave a Reply