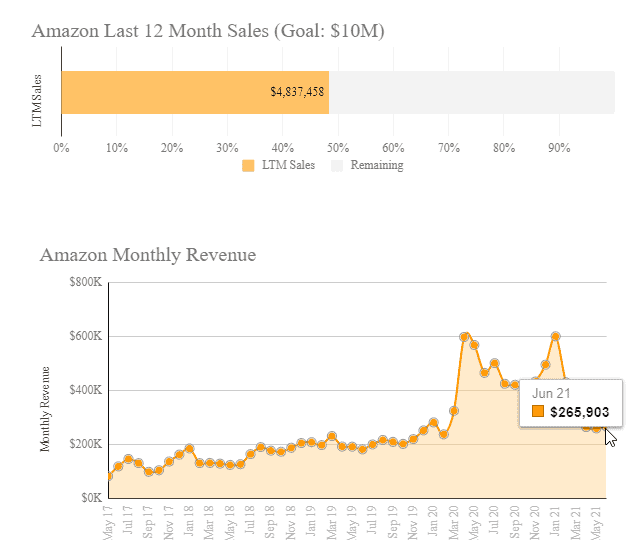

Here’s the current Gorilla ROI Amazon sales progress. To see the interactive version, go to our income reports page.

Note: These monthly updates are for educational purposes only.

Article Summary (TL;DR)

✅ Explore the performance metrics and milestones achieved in May & June for our FBA business.

✅ Gain insights into the challenges faced and lessons learned during the month, highlighting opportunities for improvement and future growth.

✅ Learn about the strategies implemented to drive sales growth, including inventory management, pricing optimization, and marketing efforts.

Q2 is finished and I’ll break down the following of what’s been going on with our Amazon business.

- May and June summary

- What happened?

- Amazon algorithm updates & fighting to stay listed

- Updates on global supply chain and making decisions based on data and finances

- NEW Gorilla ROI functions and templates

First, the numbers as usual.

May stats

- $259k in sales.

- Down vs last year.

- Down vs last month.

- -54% down from the same month last year

- -2% down from the previous month

- Conversion rate improved to 32.6% vs 31% the previous month

- ACoS decreased to 23.5%.

- TACoS decreased to 10.1%.

The projection for May came true. Bad month. See how June did.

June stats

- $265k in sales.

- Down vs last year.

- Up vs last month.

- -43% down from the same month last year

- 2.5% up from the previous month

- Conversion rate stayed the same around 32.7%

- ACoS increased to 33%.

- TACoS increased to 16%.

- June Sales to Inventory ratio decreased to 1.18 (higher is better)

Ouch. I’m licking my wounds from a bad Q2.

Interesting times because it’s the first since 2012 when I started selling on Amazon that sales have gone in the wrong direction.

Thankfully, we were still profitable in the first half of the year, but look at the jump in ad spend in June.

Profitability will be out the window in Q3. The saving grace is that last year was so good, we managed to save a lot of cash for times just like this.

The goal was to reinvest last year’s profits into new products, but the plan is now to reallocate and adjust based on the new strategy we have of righting the ship and getting back on track.

16% TACoS is the highest I’ve ever experienced.

- 40% gross profits

- 25% operating profit (where 16% is now the ad spend)

- = 15% net profit

My goal has always been 10% which rose to 13% in competitive times. In July, my TACoS will likely hit 30%… A staggering jump that wipes out all profit.

However, there’s a method to this madness.

- Low starting prices to get some traffic and sales

- Bid high to see what keywords convert

- Optimize listings for keywords that do the best

- Keep repeating 1-3 until a decent number of reviews come in

- Slowly increase prices

- Decrease PPC bids

- Find the best balance

We’ve recently launched a new lineup in a competitive industry. The CPC I’ve been used to until now are all less than $1, but with bigger players currently dominating the market, CPC is up to $2 or more for certain products.

It’s just unbelievable what people are paying to get their product showing on the first page.

A few strong competitors are dominating the niche with 10k+ reviews. They are entrenched, but if I can squeeze in and ride out these tough times, I can envision a very strong long-term future for our new products.

For now, there is no choice other than to pay-to-play.

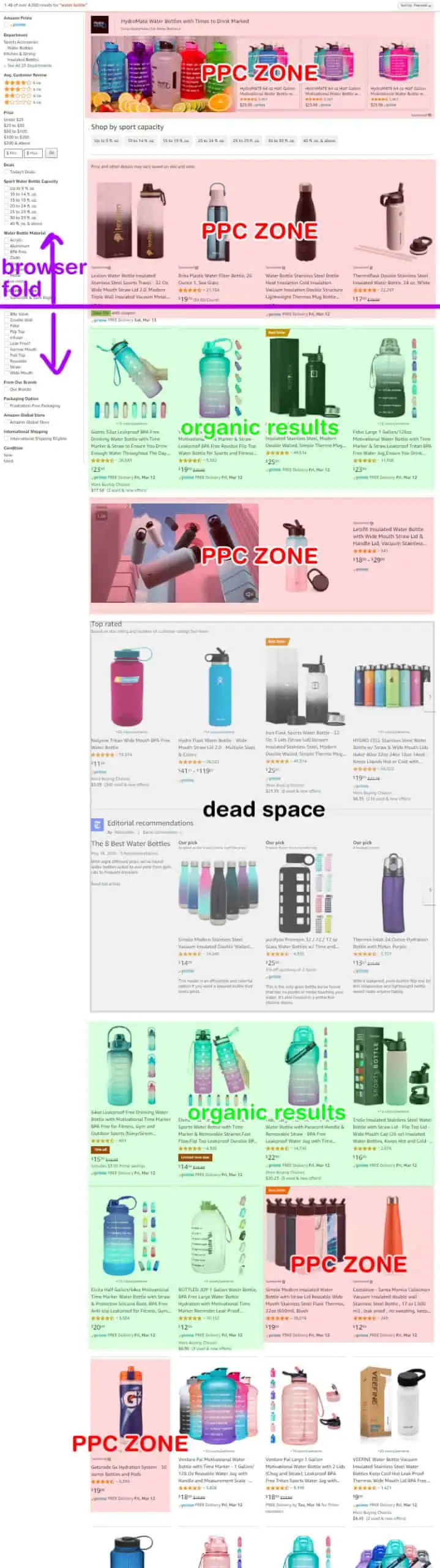

This PPC screenshot shows some green for organic ranking, but I won’t be surprised if every position becomes PPC.

What about the 50% downturn?

In the February report, I shared the details of our #1 listing being deactivated by Amazon for a bogus used as new condition complaint. 1 complaint out of 100K orders and Amazon decides to shut it down, because, it’s what they do.

This was a $2M+ listing. It was the bulk of our Amazon FBA sales obviously.

We spent a lot of time trying to get this one back up, but it has been shot down repeatedly without being reviewed.

The responses from Amazon have been pathetic at best. Seller Central forums are a joke. We have been on the phone with support, endless tickets, and spent a ton of time and money to revamp operations to take ownership of a problem related to a customer who marked it as used to get a free return.

It got to a point where I made the decision to forget about this listing and to focus on getting the rest of our top 5 products performing higher to cover up the loss.

But Amazon is one step ahead.

Throughout March and April, Amazon decided to convert nearly half of our products into hazmat and we lost 2 months of sales fighting with them to undo the changes.

For a month, they transferred all regular inventory into their hazmat facility, then when things finally got cleared, they took another month to transfer it out from hazmat to the regular FC’s.

Just when we thought things were calming down, Amazon decides to up the ante in May and June with more backend changes and search algorithm updates.

Amazon Algorithms & Fighting to Stay Listed

My own observation is that Amazon is releasing more changes that directly affect listings.

Small and minor changes to the catalog by developers are pushed out to everyone but having a big impact.

- Any remote hint of a claim or “banned” keyword will deactivate listings. Claims related to pesticide, supplements and health.

- SDS have to be reuploaded

- Brands/Transparency taking stronger effect

- Search results not showing our products

- PPC taking over every inch of space

I did predict that as consumers begin to sue Amazon more, Amazon will end up pushing those changes to the sellers.

Sellers do make outrageous claims. Many sellers (not just Chinese) do sell dangerous, stupid stuff or outright lie on their listings.

And I get where Amazon is going by getting their developers to make changes to automate and wipe out as many bad listings and sellers as possible.

By utilizing software and broad algorithms, Amazon likely catches 80% of bad actors before they can go further, but if you know the 80/20 rule, the remaining 20% of the sellers are the important ones that Amazon tramples over.

We’ve been battling 3 main issues due to all these changes from Amazon.

Pesticide Claim Issues

Listings now require info on whether a product is a pesticide or not. It doesn’t matter if you sell printer paper. According to Amazon, your A4 or Letter size paper can be a pesticide without you knowing it.

Amazon has taken it to the extreme where a listing that uses a word from their blacklist is now a pesticide. It’s no longer about the claim like “kills bacteria”. Our listing got taken down because it had the word “soap-scum” in it which is allowed by the EPA.

Amazon is also able to parse text from images. We have a cleaning product that can be sanitized in the dishwasher.

Yup you guessed it. It got classified as a pesticide because of the word “sanitize” rather than the phrase “can be sanitized in the dishwasher” which is not a pesticidal claim.

Safety Data Sheet Issues

SDS that meet OSHA standards and provided by the manufacturer aren’t valid because seller support seems to know much more than our chemist and OSHA standards.

I thought we knew what Amazon wanted to see in the SDS, but they continue to surprise us every day. Throughout May and June, we re-uploaded an SDS for every listing rather than come in one morning and see that another strong seller was taken down.

Some listings are still considered hazmat when we are using the same SDS where the 1 pack version is approved, but the 2 pack version is hazmat. And all this time, I thought Amazon’s hiring process was to pick the cream of the crop 🤔

Brands/Transparency Issues

Another prediction here.

In a few years, it’s going to be very tough to resell other brands. Many brands you can’t even mention their name on a listing, even if the product is compatible with the big brand product.

If I’m selling a filter for a GE fridge, I can’t even mention GE without getting a takedown notice or IP infringement.

We asked seller support about their compatibility guidelines and the USA-based support came out and said the online policies are generic guides. Support and Amazon can do what they see fit rather than stick to what they publish. You see this all the time. If you sell charging cables for iPhone or Google, you’ll get in trouble for saying it’s compatible with Apple or iPhone. Even though it complies with Amazon policies.

We had some older products charged with an IP infringement because our compatibility claims used the trademark name in the listing.

How do we say it is compatible with a brand when we can’t say the brand?

Within a few years, if you are not selling your own branded product, you will be stranded in no man’s land. Brand owners will have a lot of power and authority and if they decide to file a complaint against your listing, be prepared to be wiped out.

Just like our $2M listing.

Either that or you need to get your authorization letters ASAP from the brand owners stating that you are an authorized reseller.

Container Costs Through the Roof

I’m above $15k for a single container from Asia to Seattle. Before March of 2020, a single container cost $3.5k.

At first, I thought it was natural supply and demand, but now I call BS on it.

There are 3 suppliers in China that manufacture 80% of the world’s containers. The other 20% are mostly all Chinese too.

See where I’m going?

If other countries also manufactured containers, the absurd cost to find a container wouldn’t be where it is today. It’s because China is a monopoly and with the profit they are reeling in per container, why would they want to kill the golden goose? These companies used to run on thin margins. Less than 5% net is my guesstimate. And if they are now seeing net margin of 20-30%, and control the industry, you’d be crazy to think they are working as hard as possible to drop their margins back to sub 5%.

Follow the money trail. Blaming it on covid or containers being left in the US is only a tiny part of the story. That’s old news.

If I had a monopoly I would do the same thing.

- Used to operate on thin margins

- 1 country controls the market

- Receives a massive backlog of orders and demand

- Build at a steady pace to meet 60-80% of demand

- Charge 3-5x normal prices

- Say we are doing our best and have ramped up production *wink wink*

- Keep it like that for as long as possible to maintain the current demand at inflated prices

All this dependence on China manufacturing really is costing us (and the rest of the world). We’ve increased our USA manufacturing to be less dependent on China this year. The transition will take a few years, but I want to get 50% of sales coming from USA-made products.

Build resilient and redundant supply chain

Having an efficient supply chain is in the past now. It comes in 2nd behind a resilient one.

If you are not on top of your operations, you’ll be blindsided when there are delays. Simple things can prevent you from losing revenue from bestseller stockouts.

Read my detailed analysis on Amazon supply chain management. Here’s a quick summary.

- Create a redundant Amazon supply chain

- Diversify suppliers around the world

- Diversify products

- Diversify freight forwarders

- Redundancy in many areas

- Know every piece of the Amazon SCM puzzle

- Run a nimble supply chain strategy for Amazon

- Invest in technology and a backup

Financial Management and Decision Making

People think I’m this super smart guy simply because I share all of these numbers. But the reality is that anyone can do it.

It’s just knowing your numbers. You don’t have to track as much data as I do, but when you know what to measure, everything changes.

What I see over and over again is that the low-end to mid sellers only track silly vanity metrics like sales. There is no target or benchmark they are trying to achieve.

Having benchmarks, knowing what is a good or bad level for your business can take you from losing money to printing money.

Pre-2013, I was losing money every year, and then I finally sat down and looked at my profit and loss, I realized my prices weren’t high enough.

I feared we would lose tons of sales if I raised prices, but I did it anyway because there was no other choice and it didn’t make sense not to. I raised prices and that very year, we made our first profit for the year by a mile.

We’ve never looked back.

These reports help me to write down and summarize in writing what is going on, but I also regularly review my financials because the numbers don’t lie. The P&L shows you cold hard facts.

At a minimal level, you have to set your target for the following:

- Sales growth (e.g. 50% year-end)

- Gross margin (e.g. 40%)

- COGS % (e.g. 20%)

- Net margin (e.g. 20%)

- Marketing spend % (e.g. 10%)

Just setting a target like this changes your decision-making and perspective of how to run your FBA business.

Nowadays these numbers are so easy to get. Lots of Amazon FBA software to collect and report these numbers. We do it with Gorilla ROI and can track sales, refunds, profit and loss, reimbursements and more.

Make data work for you, not the other way round. Otherwise, you’ll keep procrastinating and continue to drive blind.

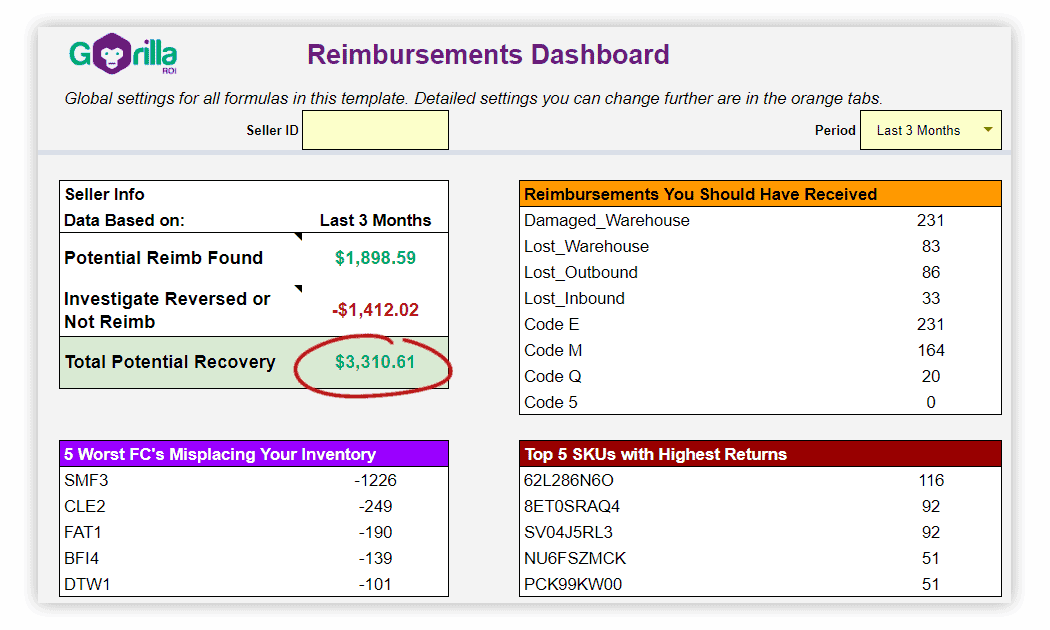

NEW Reimbursements Gorilla feature

Check out our Amazon Reimbursement data plan.

- It’s a time and money saver like no other.

- We are able to process 5x more reimbursements than before now that the transactions and data are automated.

- We don’t have to give 10% of reimbursements to an external company.

- Fully transparent. Our employees now have the knowledge to handle reimbursement work in-house.

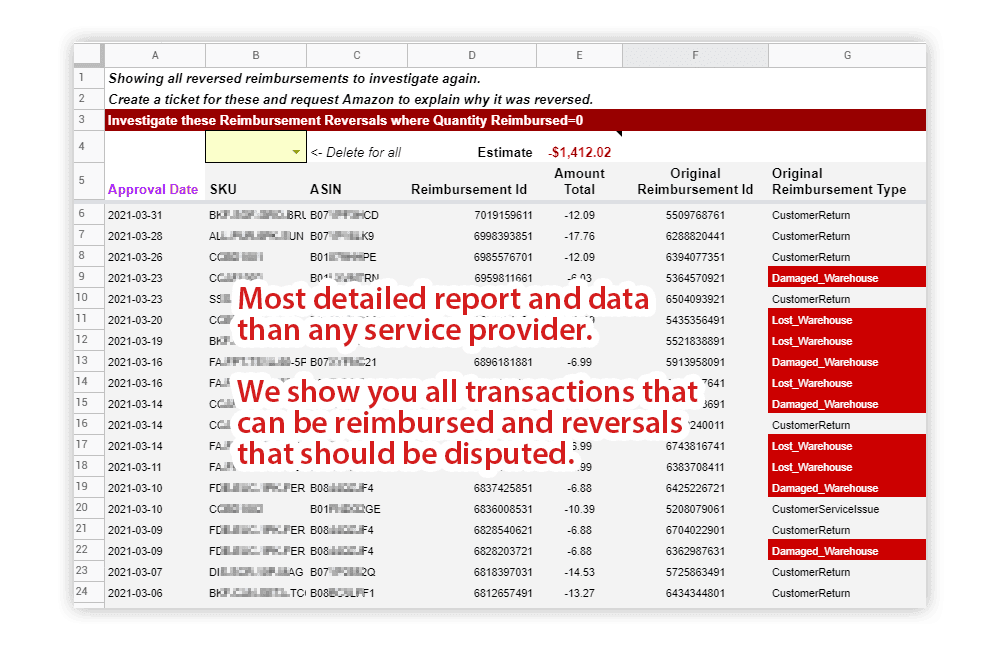

Manually trying to figure out reimbursements is complex and tedious.

There are many good agencies and service providers who do this, but you end up paying a percentage of your profits to them.

Our reimbursement plan is an addon subscription to your current subscription plan.

This is the reimbursement spreadsheet preview link.

A couple of screenshots of the spreadsheet.

With the Reimbursement add-on, you will be able to get the following new reports:

- Reimbursement report

- Inventory adjustments report

- Returns report

- Shipments report

By combining all of these reports and with the help of the reimbursement spreadsheet, you can request reimbursement for lost and damaged items, incorrect returns, see which FC’s are misplacing your items, incorrect sizing fees and more.

Learn more about the Amazon Reimbursement plan. You can add it from your account directly.

NEW spreadsheets and updates

We’ve completely remade some existing spreadsheets and added new ones for PRO package users. Log in to download the latest from your account.

Articles published

- Updated the best software for FBA sellers and what we use.

- Amazon keeps coming up with new fees. I updated the FBA inventory reimbursement guide for sellers

- Updated a quick financial analysis of an FBA business if I was planning to buy it. With buying FBA businesses becoming popular, it will help you with what to look for and how to think through the numbers.

Comments

5 responses to “May & June FBA Monthly Update (Combined)”

-

Hi,

I just got started 6 months ago selling on amazon. I’m working on building the systems and procedures for my business, utilizing an app I made. Aside from the gorilla sheets you’ve created, what kind of automation do you use in your business? How many employees would you say it takes to run a business your size? -

Here’s what we wrote about the other tools we use.

https://www.gorillaroi.com/best-software-for-fba-sellers/Nothing fancy. Tried about 20 other software, but in the end, we keep coming back to Google Sheets because of the flexibility and customizability.

Zapier is probably next in terms of how much we use it.

With the right process and just making sure you set things up properly, you can run a $1M store with 1 employee at most. Too broad of a question as it all depends on what you want to outsource vs keep in house.

-

Thanks for your response! What do you recommend in terms of funding an amazon FBA business? Is there a path of least resistance for securing funding for an amazon FBA business? Of course there are a number of variables related to loans amounts, lines of credit, angel investing, etc., but is there one funding strategy that has worked better for you than others? Or do you use multiple funding strategies (individual investors vs banks) for you FBA business?

-

Try not to get a loan or an investor until you are very experienced. You will lose it. Bootstrap it because Amazon can turn out to be a low margin business. Save, invest, reinvest. Don’t expect to make money from the beginning. Have a 2nd source of income if you can to keep funding it until it can stand on its own.

-

Good advice, thank you.

-

-

-

Related Posts

Unlock the Secret to a Profitable Automated Amazon Store: How to Build a Hands-Free Income Stream

Ever dreamed of running a profitable Amazon business while sipping…

Master Amazon New Restricted Keywords: A Seller’s Guide to Success

Changes to Amazon’s restricted keywords list have taken a lot…

How Amazon DSP Works: A Guide to Programmatic Advertising for Amazon Sellers

Learning how Amazon DSP works could be a powerful advertising…

Leave a Reply