Article Summary (TL;DR)

✅ Various strategies for pricing products on Amazon are available, including fast turnover with low profit, slow turnover with high profit, loss leaders, promotions, and distribution pricing.

✅ The focus here is on pricing fast to mid-turnover items while maximizing profit and maintaining cash flow.

✅ Aim for a 40% gross margin as a starting point to accommodate for failed products and business expenses like advertising, payroll, and operating costs.

✅ Pricing too low can lead to razor-thin margins and negative cash flow, emphasizing the importance of balancing profitability and cash flow in product pricing strategies.

Before getting started, note that there are many strategies on how to price products based on your Amazon selling strategy.

- Fast turnover, low profit

- Slow turnover, high profit

- Loss leaders

- Promotions

- Distribution pricing

But the focus of this article is to look at product pricing for fast to mid turnover items while maximizing profit.

One tool that has helped our business growth tremendously is knowing how to price products properly based on the channel. Now, our focus is to always prioritize profitability AND cash flow without sacrificing (too much on) turnover.

I see a lot of articles and videos talking about margins and “net profit”, but note that profit is not cash flow.

Actually, from an accounting standpoint, calling your Amazon profit “net profit” is very wrong and will give a false reality of your bottom line. The “net profitability” definition on Amazon’s calculator is really gross profitability.

Very dangerous to confuse the two.

So when people say they get a profit of 40%, they really mean gross profit and after operating expenses, it could range from 0% to 25% net profit depending on how much they are spending on advertising like PPC, tradeshows, Facebook, giveaways, R&D and so on.

These are all operating expenses. Not cost of goods sold.

How to price products for Amazon

To successfully price your products on Amazon, these are rules of thumb you can apply.

Our goal is to aim for 40% gross margin products as a starting point and rule of thumb.

This kind of margin gives us plenty of breathing space to compensate for failed products (which happen regularly) and also provides us with enough cushion to continue product development, spend on PPC and other businesses expenses as mentioned above.

But why does it have to be 40%?

While all businesses are different, here’s a better breakdown of what you have to pay for to keep running your business and generate sales.

- product cost – COGS

- freight cost – COGS

- shipping to amazon cost – COGS

- labor cost – operating expense

- advertising cost – operating expense

- payroll – operating expense

- utilities – operating expense

- rent/lease – operating expense

- legal – operating expense

- other fees and interest – operating expense

- marketing – operating expense

- taxes – other expenses

- travel – other expenses

- (there’s more I didn’t mention)

E.g. wholesale sellers that operate with 10-20% gross margins walk a tight rope. One wrong move and they fall in the red.

Looking for products that can achieve 40% margins gives you breathing room.

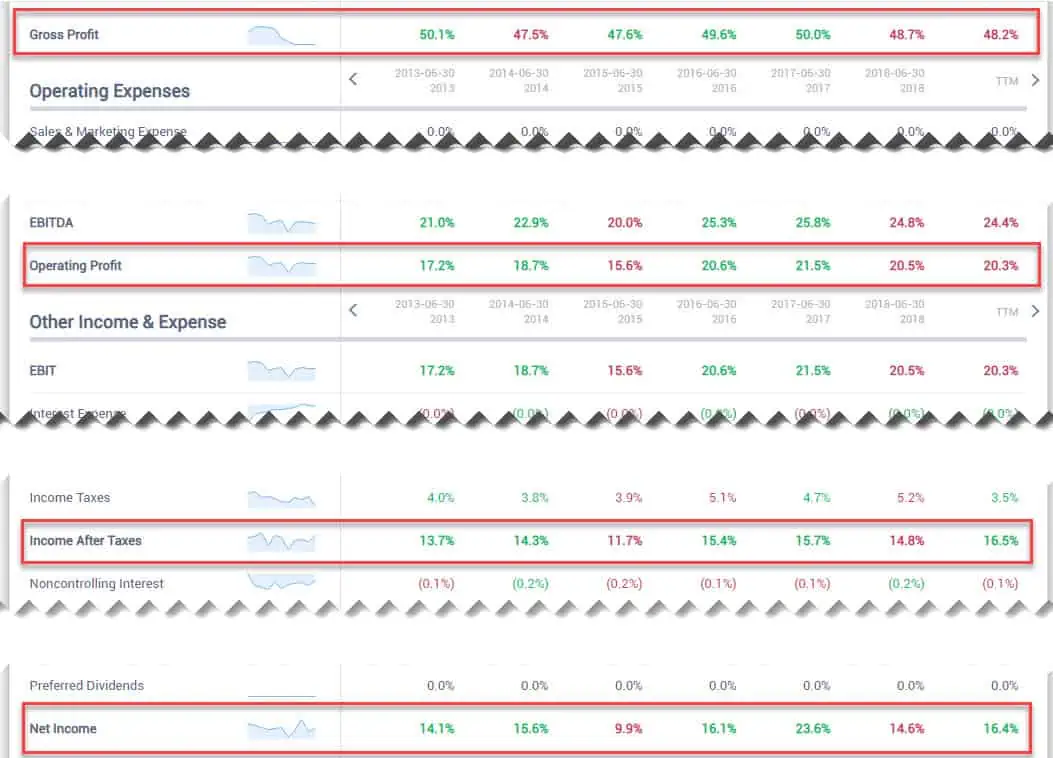

Take a look at the financials for Proctor and Gamble. Click to enlarge.

They work with 50% gross margins which should be the baseline for any wholesale business. When we sell to our wholesale customers, we make sure that our margins are also at 50%.

As you go down the financials, note that operating margins comes in at 20%. This means that 30% of the revenue go into operating the business.

This is close to what we have going on and it’s the max level for an Amazon business. We range from 25% to 30%.

If operating expenses exceed 30% of revenue, then there is too much fat and waste in the business.

Keep going down and taxes are real. They should be included in your calculation. Finally you get to net profit where PG shows 16.4% TTM.

Very strong and healthy business.

If you sell outside the US, where taxes are included into the price, you have to factor that in to your pricing as well.

If you don’t include business expenses like the above points into your calculation, you could end up cash flow negative, despite having a profitable product.

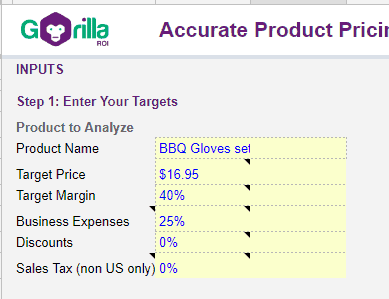

Introducing the Gorilla ROI Amazon pricing calculator

Here’s an example of BBQ gloves you see all over Amazon.

This one is priced at $16.95.

Reverse engineer the product pricing

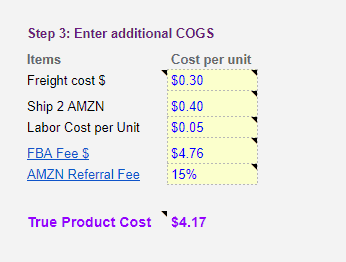

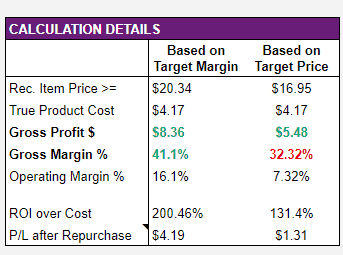

In our pricing calculator included in the PRO Spreadsheet Package, I’ve entered the

- selling price as $16.95

- target margin of 40%

- 25% overhead expenses (my rule of thumb)

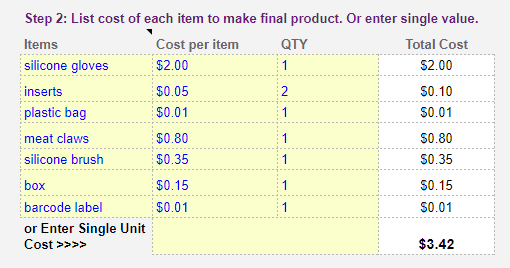

I don’t know the exact cost breakdown of what is included in the product, but based on experience, I’ve jotted down what I would potentially pay.

It’s also easy to go on Alibaba and get prices of each. Doesn’t have to be accurate.

Don’t forget the other COGS.

Once that is done, you see the product cost is not $3.42.

It’s really $4.17 once it reaches the Amazon warehouse. This is the “landed Amazon price“.

What’s should I price it at?

Now the important question is what price you should sell this product.

- One way is to enter different prices and calculate the margin each time.

- The other is to work backwards for the margin you want and find out the price.

The quickest way to do both is to use a sensitivity matrix.

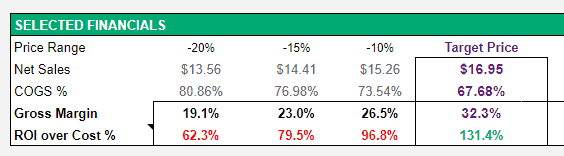

The above table is a simplified P&L statement with varying price points.

At $16.95, the gross margin ends up being 32.3%. I am confident this is close to what the seller is actually getting. Probably between 30-35%.

Question is, is this price profitable and is it a good price?

Let’s see.

If my goal is to achieve 40% gross margins, I’d have to sell it at $20.

$16.95 is a 32% gross margin product, and although I would make $5.48, the TRUE cost to replenish inventory to Amazon’s warehouse will be $4.17. This means I’m left with $1.31 in my pocket.

This is money I can use to pay taxes, develop new products, increase spend on marketing etc.

Now compare that to the $20 recommended price to get 40% margins.

For each sale, I’d gross $8.36.

$4.17 will go towards inventory which leaves $4.19 per unit in my pocket.

The rest can be used for your marketing and other operating expenses.

The real difference is in the operating margins.

Both prices are profitable and will be cash flow positive. But the $20 price point gives you 16% operating margins while the $16.95 price point leaves you at 7.3% operating margins.

If you go back to the top and look at Proctor and Gamble’s financials, you can confirm their operating margins at 20%. So you want to make sure your operating margins will come to at least 15% as a minimum.

Because Amazon takes such a big cut of your sales price, our goal is for at least 10% to 15% operating margins based on the product. Overall, we are looking for 15% at the end of the year.

Anything less, and it leaves less room for error. Also, if a certain product demand spikes, the extra percentage points helps to have a strong cash balance ready to double down on inventory and expand when necessary.

With 7% operating margins, investing in double the inventory quantity will strain your business – especially if another product requires 2x inventory.

Never join the race to the bottom

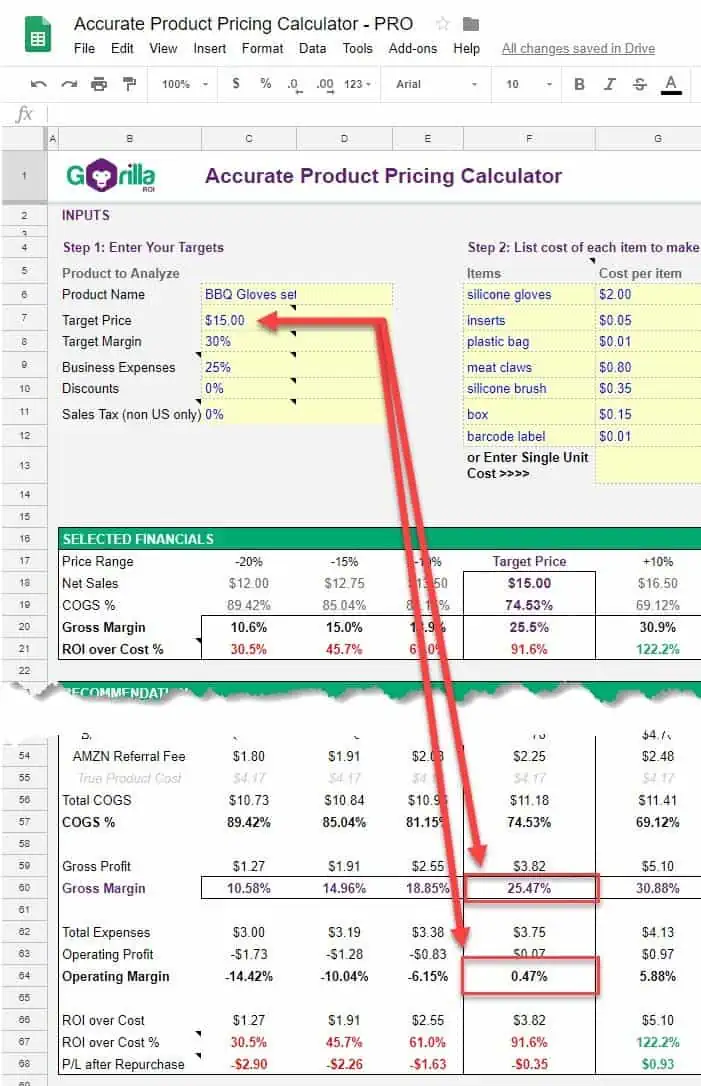

As the last example, if I was to price this item at $15, you can see what a difference it will make.

It may look profitable at $15 with a 25.5% margin, but after business overhead, you are left with 0.5%.

Razor thin margins. After taxes, your net margin is negative. You lose money for every unit sold.

Don’t just price products for profits, price it for cash flow too, and find that balance.

Alternative FBA Calculators

Another alternative you can use are online calculators that go beyond what Amazon provides.

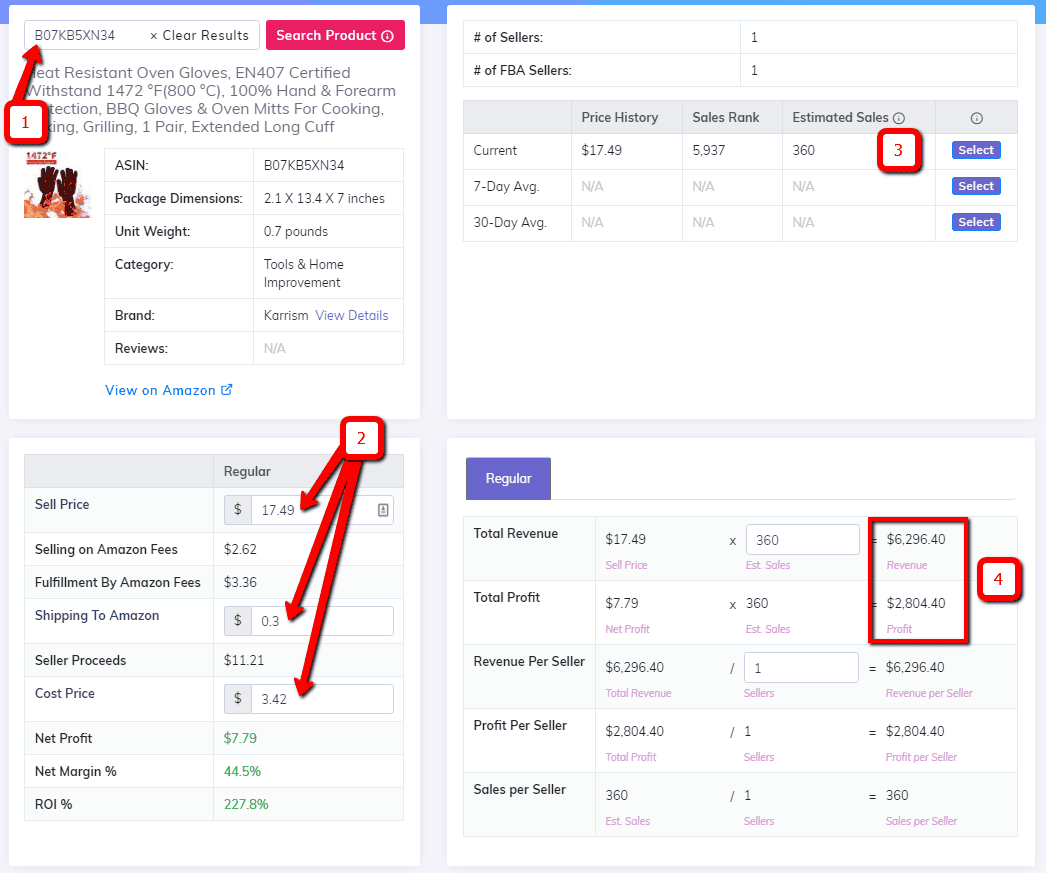

Here’s one example of an Amazon FBA calculator you should check out by ProfitGuru

Love the clean and easy-to-follow presentation. If you follow my screenshot, you can take it from steps 1-4.

Enter the ASIN of interest, the costs associated with the product as I did in my profit calculator, and the potential profit is calculated for you.

The difference in figuring out how to price products with my spreadsheet vs other online tools is that it’s easier to break down the details via spreadsheet. The spreadsheet is also focused on determining your best selling price based on your margin requirements.

Online tools are great for scouting and quick analysis as you can see above.

If you need a better handle on your pricing, check out the pricing calculator in the PRO business package along with other operational docs that will help you get a better handle on your business.

Comments

2 responses to “How to Price Products for Profit and Growth (Case Study)”

-

I dont understand why u said u just get 5.48$ when u are getting 5.48$ + 4.17$ that is the cost of product + shipping.

U are just letting in the table the amazon % + logistic fee in that example.

So u get 9.65$ per unit sold.

I think there is some kind of error or something.

-

$16.95 is a 32% gross margin product, and although I would make $5.48, the TRUE cost to replenish inventory to Amazon’s warehouse will be $4.17. This means I’m left with $1.31 in my pocket.

-

Related Posts

10 Profitable Product Categories for Amazon Affiliates 2025

What you’ll learn Amazon is a favorite for experienced and…

Unlock the Secret to a Profitable Automated Amazon Store: How to Build a Hands-Free Income Stream

Ever dreamed of running a profitable Amazon business while sipping…

Master Amazon New Restricted Keywords: A Seller’s Guide to Success

Changes to Amazon’s restricted keywords list have taken a lot…

Leave a Reply