What you’ll learn

- Jungle Scout

- Amz Scout

- Helium10 is up there too

Amazon competitor research and scouting tools have changed the way you source and get data, but there comes a risk with using the tool.

What I’m going to show you is when and when not to use these research tools.

Not the how’s or how not to use.

There are too many tutorials and even training videos of people wanting to make affiliate sales who post videos and articles on how to use it and why you should.

But this post is different.

No affiliate links here. Just straight truth of when and when not to use Amazon research software.

Let’s go.

How Amazon research tools work

One area I find sellers to be overzealous is in the area of data protection and fear that a software company will steal their product idea.

I have found this to be far from the truth.

The real fear shouldn’t be whether the software company is going to use your data. But whether they use your data as part of their service to other users.

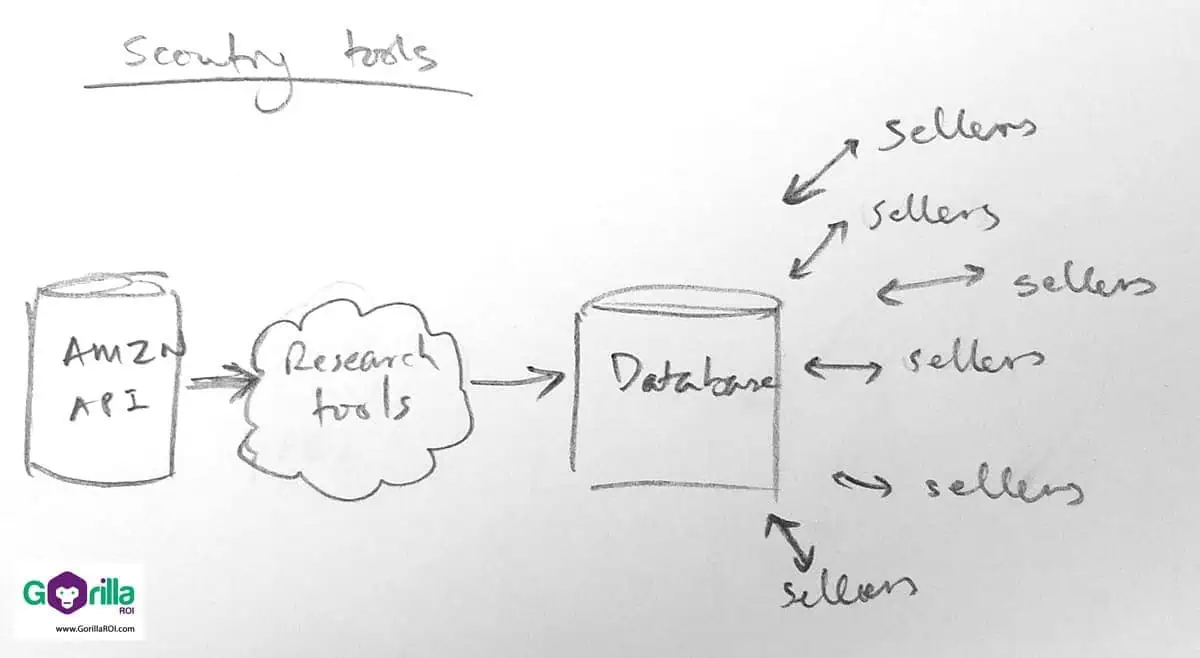

Scouting and research related tools work like this:

- You give access to the tool and enter your seller ID and authorization token.

- The software will start to download your data via the Amazon API.

- (It’s fine up to this point because you can sever the connection anytime from seller central to protect your account.)

- Free chrome addons or paid extensions for scouting and researching require you to feed the software company data.

- The software will scrub, flatten and re-arrange the data so that it can be used.

Next comes the biggest difference between software tools.

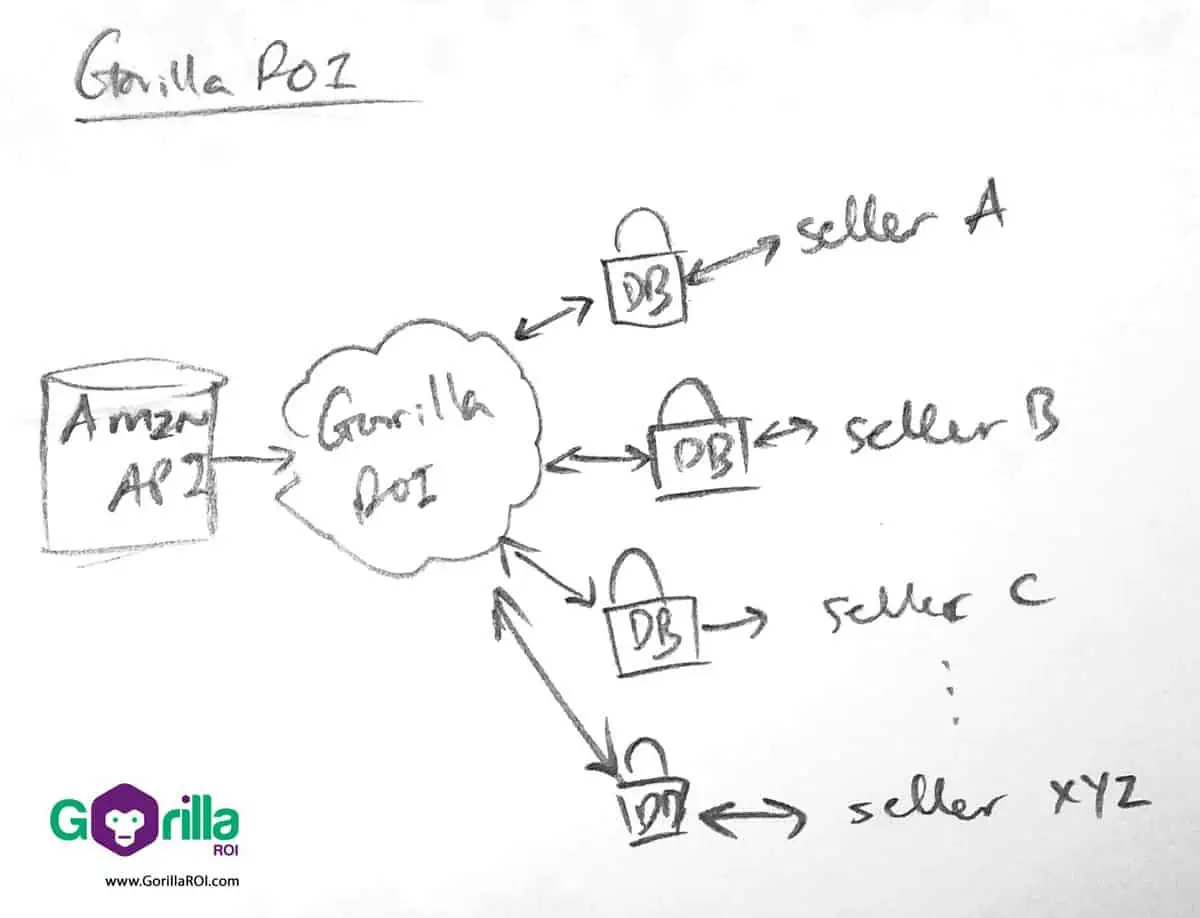

- Any tool that offers research functionality like inventory lab or paid web app tools will make your product searchable and viewable. It’s open for anyone paying for the software to access, find and analyze your product. This is called “one to many” access.

- Software like Gorilla ROI and accounting tools (think Quickbooks) do not share your data with anyone. It is siloed to your account. Meaning we provide 1-1 connection access only. No one outside of you can see or find your data. Our service is not dependent on being fed data from other users for the rest of the user base to see and use.

If you sell yoyo’s, another seller will not be able to check your sales data on yoyo’s even if they know the ASIN. Each seller can only access their own data. Everyone is permanently walled off from each other.

Knowing this important if you are worried about other sellers finding your product.

Don’t like the idea of companies selling your data? Well, this is what research tools do. They scrub your personal and company information and then repackage it and sell their software for others to use the data.

When to use scouting software

The best time to use Amazon scouting software is to perform research on a product or to find a category or idea.

Think of it as a filter.

Scouting tools help you when you are at the top of the funnel with thousands of different products and categories to choose from.

It helps you narrow the list down.

The lower you get in the funnel, the less you need scouting software.

I won’t get into the details of how to use the tool because there are so many tutorials out there.

When not to use Amazon scouting software

I’ve used Jungle Scout, Helium 10, seller app, and countless other tools. I canceled all accounts that offered an all-in-one service and ultimately chose AMZ Scout as my chrome extension.

With the majority of Amazon sellers using Jungle Scout, every time the tool is run on a particular product, the data is entered into the Jungle scout servers.

You guessed it.

The more people there are using it, the more likely people will find it.

With AMZ Scout, it’s lesser to some extent.

The key is once you have identified your niche and product, stop using the scouting software. There is no need to continually feed the latest data into a database for tens of thousands of other people to find.

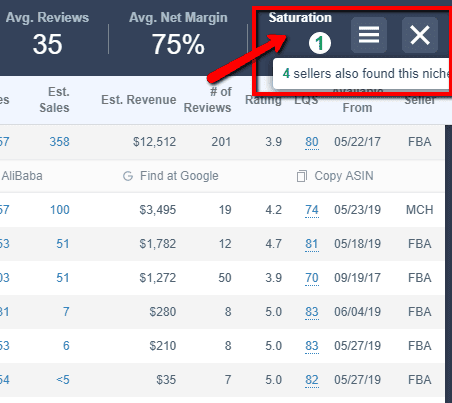

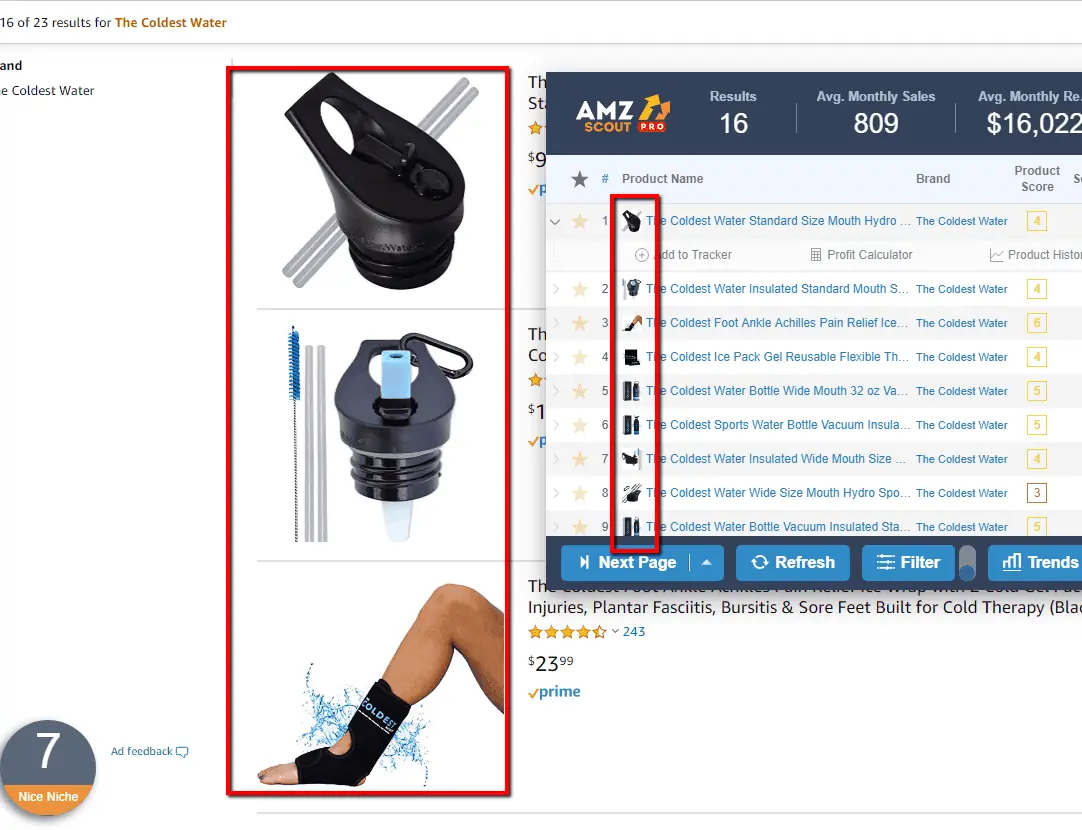

One day when AMZ Scout made an update to their tool called “saturation”, it really opened my eyes to the data they are seeing.

This is for a random skin routine product I came across. Looks like 4 other people found the exact same product and brand.

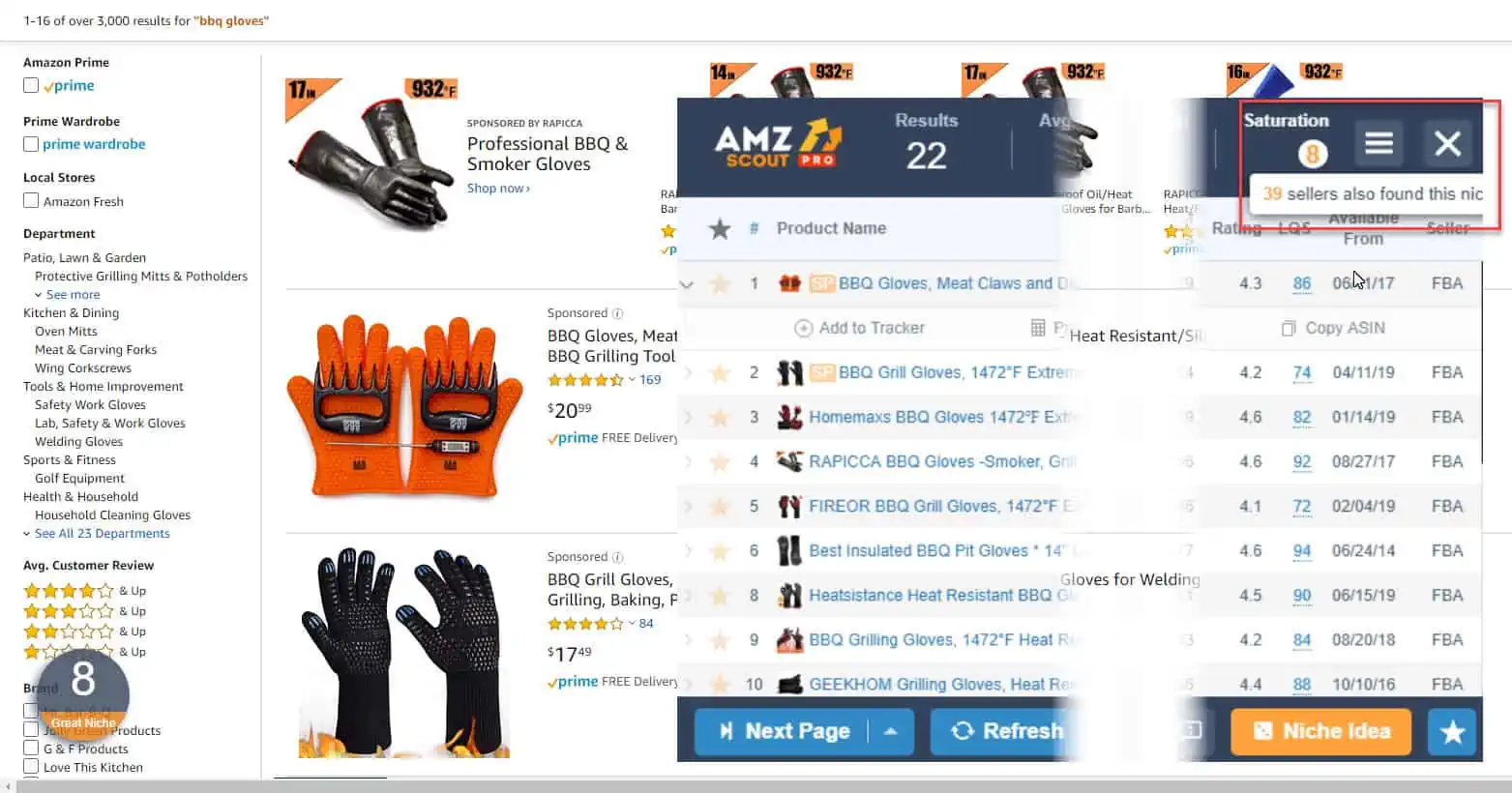

Here’s a look at bbq gloves. One of the most copied and private labeled products on Amazon.

Other tools have the same thing, but AMZ Scout now shows you how many other people are searching for it.

I assume the numbers are calculated based on a monthly tally or something. 39 people in the last 30 days looking for bbq gloves. Not a product I want to be in.

For this very reason, once you know your product, it is better to try and keep it under wraps by not using scouting tools.

You have the experience and judgement to figure out how much something sells based on the BSR.

The best way to use research software

Using these tools to keep tabs on your competitors is a good strategy.

BUT

If you are searching in such a way that will expose your product, then it’s not good.

The better way is to use the research tool on your competitors Amazon storefront.

- Not the search results after typing a keyword

- Not the listing page

The Amazon Storefont – because it will only list the products in their storefront in the tools.

This way, you can hide your product while giving AMZ Scout or whoever, the data of your competitors.

Sure.

People can still trace it back to your product, but at least you aren’t updating your product and data for all to see.

Summary

- Scouting and research tools are great and have made work so much easier.

- Once you get past the initial stages of finding your niche and product, stop using the tool.

- Publicly available tools require data to be loaded onto the servers allowing for others to use it.

- Use the tools to look up competitor storefronts.

- Use your internal data to keep track of your sales like with Gorilla ROI.

Comments

Related Posts

10 Profitable Product Categories for Amazon Affiliates 2025

What you’ll learn Amazon is a favorite for experienced and…

Unlock the Secret to a Profitable Automated Amazon Store: How to Build a Hands-Free Income Stream

Ever dreamed of running a profitable Amazon business while sipping…

Master Amazon New Restricted Keywords: A Seller’s Guide to Success

Changes to Amazon’s restricted keywords list have taken a lot…

Leave a Reply