Article Summary (TL;DR)

✅ Learn about the strategies implemented to drive sales growth, including inventory management, pricing optimization, and marketing efforts.

✅ Explore the performance metrics and milestones achieved in November for our FBA business, reaching $304K in sales.

✅ Gain insights into the challenges faced and lessons learned during the month, highlighting opportunities for improvement and future growth.

Here’s the current Gorilla ROI Amazon sales progress. To see the interactive version, go to our income reports page.

Note: These monthly updates are for educational purposes only.

November stats

- $304k in sales.

- Down vs last year.

- Up vs last month.

- -30% from the same month last year

- +12% no change from the previous month

- Conversion rate of 31.2% vs 31% the previous month

- Session value increased to $6.02 (sales ÷ sessions) vs $5.50 last month

- ACoS decreased to 30.3%.

- TACoS still too high at 16.1%.

Short version: Trending in the right direction with clearer objectives.

Missed the October update with many things going on at Gorilla ROI, so the update had to take a back seat. If you go through my past monthly reports, you’ll see some metrics looking better.

The sales are still down and will go down another 25% next year. I’ll get to that later, but it’s good news now.

Over the past several months, I’ve changed my high-level Amazon KPIs. These are my key performance indicators:

- Conversion rate

- Session value

- TACoS

- Average selling price

Sales will never grow unless you do something about the 4 metrics above. Because sales are simply a result of your strategies.

To improve each of the 4 points, I reference my own mega-post on Amazon listing optimization so as not to try and do too much.

Here are the numbers I’m plugging into our Amazon revenue calculator and forecaster.

The biggest jump this month is the average order value of $28.95. Even until Oct, our average order value was $21. This is a massive jump due to the new high-priced item we’ve introduced.

That particular item isn’t profitable yet as it is big, bulky and Amazon continues to measure it incorrectly so our FBA fees for that item are so off, it’s not funny. Wiped out every last cent of profit.

TIP #1 Monitor the dimensions Amazon is measuring for your product as it can change regularly. HOW? Use our formula =GORILLA_PRODUCT() to load all your package dimensions and weights. Use =GORILLA_FEESESTIMATE() to load your fees.

With those inputs, here’s what our forecaster is telling me.

I enter 0% for the growth rate because I want to see what the latest month-end improvements will yield when stretched out over 12 months.

If I can keep things chugging along at the current conversion rate and price points, we should technically be able to get back into the $5M territory and recover the lost $1.5M of revenue from our number 1 best seller that got wiped out.

But that’s theoretical at the moment because as I alluded to at the beginning, I’m coming up against another 25% drop in revenue soon.

Wholesale supplier pulled rug from under us

60% of our business comes from our own brands and products. The other 40% came from a single brand we sold as distributors.

Our #1 best seller went down because of two selling used as new complaints by shoppers, over hundreds of thousands of orders. Every plan of action we provided failed.

No matter how much evidence, improved processes outlines, additional resources spent, and retraining that we showed, Amazon rejected our request within 10 minutes of submission.

And we didn’t copy-paste if that’s what you are thinking. We painstakingly spent hours and hours for weeks going over the tiniest of steps, talking with the supplier, changing our boxes, packaging, and more.

So we started to get the impression that the brand owner could be playing a role in this.

I can’t confirm whether our hunch was correct, or whether it was another Amazon monkey trained to click the POA reject button as soon as they see something in their inbox, but in Q2, we are informed by our supplier that they will handle all direct to consumer sales on Amazon.

I do admit that we were very fortunate to have found their brand when we were starting out and when they were barely selling anything on Amazon.

We took their product and started selling millions of dollars worth on Amazon, until they decided they wanted 100% of the pie.

But this is good news. If this happened when we were selling $5M or more of their product alone, and then they threw us under the bus, it would have been a catastrophe.

We relied heavily on their product and believed that they enjoyed our partnership too.

Without this happening to us, we wouldn’t have started looking for alternatives, thinking of expanding to a new product category, and putting our heads down to strategize and find ways to recover the revenue.

If we can recover the lost revenue with our own branded products, it’s going feel awesome.

TIP #2 Diversify your sales with multiple brands and product lines.

Fees, inflation and pricing

I knew this was coming. Increase in seller fees.

I’m on a rampage to cut extremely tight margin products. No point in putting in a lot of effort for close to zero profits.

If I was running a retail store, I would use loss-leaders as a strategy to entice customers to come and buy other stuff. On Amazon, it doesn’t work for my cleaning products.

Amazon customers are not brand loyal. They are loyal to “Amazon”, but not the sellers. Most people still don’t understand that they are buying from sellers like us and think that it’s Amazon and Jeff Bezos they are making richer. Pfft.

Inflation across the board is real and it’s much higher than what the media says because it doesn’t include food and energy costs. November inflation of 6.8%? More like 10+%. If you sell wholesale food products, I doubt your prices stayed the same and I bet your purchase price is higher than 10%.

We have been regularly adjusting our prices but with a decrease in profits, higher expenses, 2-3x more cash outflow required, I decided to raise our prices on everything.

My team and I revisited every product, broken down every single touchpoint and cost related to the product. The final result is that we increased our prices from 15-25%. So far, it hasn’t affected our overall dollar sales figure. The units sold has come down slightly, but the total sales number is higher.

And that’s exactly what I wanted.

Why bother doing extra work for $0 profit? It’s the same as doing zero work for $0 profit. And if I’m not wasting time that yields 0% ROI, I can spend that time on strategizing, and thinking big picture stuff.

I’m also shifting towards selling less, for more. Otherwise, I can’t keep up with the increase in fees and inflation for low-priced products.

I also understand that as a small business, we don’t have the flexibility and options that big companies attract. I’d love to borrow a billion dollars at 0% like Warren Buffett. But knowing this isn’t the case, I’ve focused on the mantra that cash is king.

As much as I like growth, I do err on the conservative side. Growth is like a drug. If you get addicted, it gets very dangerous because you end up throwing caution to the wind.

1. Prepare for the worst. Hope for the best. 2. Build a business for the long term.

When I say prepare for the worst and hope for the best, it is based on the idea that:

- the business should be able to run without me

- the business should be able to survive at least 6 months with zero revenue

Like our content? Follow our journey to reach $10M in sales

We share our real failures, wins, and what we are doing on our journey from $0 to $10M in sales.

It sounds unnecessary and too much trouble until it is too late.

The important things are never urgent.

The urgent things are usually never important.

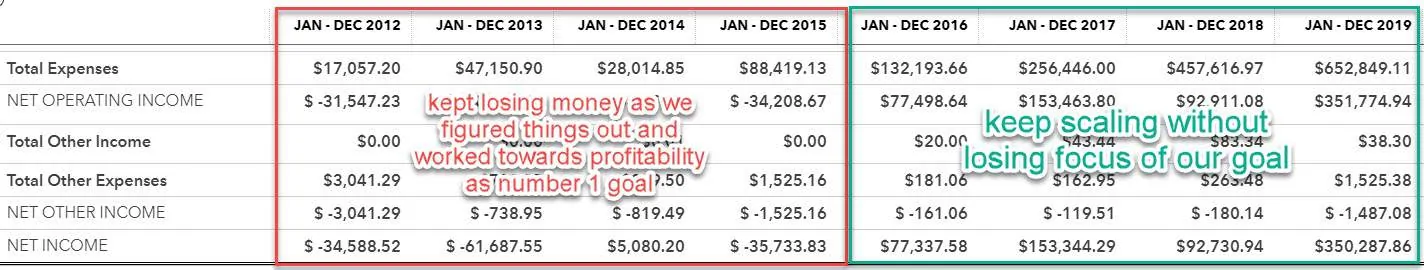

A very similar thing happened to us in 2016. It took us 4 years before we became profitable. A lot of stupid mistakes were made and the culprit was not reviewing prices properly.

Once I raised prices, everything flipped.

Look at the net income line between 2015 and 2016.

We went from $-35k to $77k.

The biggest factor was going back to basics and calculating my numbers from scratch.

This single task changed the trajectory of our business.

Until 2015, I thought I was making money on products, but my calculations were wrong.

I couldn’t believe I didn’t know how to price products properly. We killed non-performing products, let go of emotional biases for certain products, reduced stupid mistakes and the rest is history.

Every couple of weeks, we transfer a small percentage of cash into an account for paying taxes, and another account for a rainy day or profit-sharing.

Check out the book Profit First. It’s easy to follow and no accounting experience is required.

Just common sense to create a healthy business and protecting yourself.

Tracking how the price change is affecting sales

With the new price changes, I wanted to verify whether it was the right call or not. If it made more sense to lower prices again and sell more, I was willing to go back.

I put together a spreadsheet to grab the following pieces of sales data using Gorilla ROI.

- Last 7 days

- Last 30 days

- vs Year Ago for the same period

- This Year

- Last Year

I wanted to keep it simple and visual to be able to see the short term and 1 year performance. Dummy data is used in this screenshot.

The red box highlight is what I’m most intersted in looking at.

Over each period, I’m comparing the sales total and I want to see how many products are up, down, or stayed the same. Simple but very useful overview.

I did the same thing with the units sold, but for me, knowing the sales total is more valuable than the units sold right now.

This spreadsheet only took me 30min to make, but it provides very actionable information and details into what is working and what isn’t.

WANT THE TEMPLATE? Let me know in the comments and I'll see if it's worth the effort to create it as a template to share.

Comments

Related Posts

Mastering Shopify’s UTMs: The Simple Way to Smarter Marketing

Let’s be honest: marketing your Shopify store without tracking what’s…

10 Profitable Product Categories for Amazon Affiliates 2025

What you’ll learn Amazon is a favorite for experienced and…

Unlock the Secret to a Profitable Automated Amazon Store: How to Build a Hands-Free Income Stream

Ever dreamed of running a profitable Amazon business while sipping…

Leave a Reply